Inflation — the silent killer & the greatest nightmare for our Government

Economists have been saying that inflation is a broad daylight theft and impacts the poor more than the rich. People think Inflation is the rise of prices on commodities, but the reality is that it is the loss of purchasing power of the currency.

I did a short video on this, you can watch it for a quick recap.

https://www.youtube.com/watch?v=kTrVnw6RNjc

Having high inflation is detrimental to a country as its purchasing power erodes, the currency gets devalued and international currency inflows stop.

The only way to control inflation is to stop printing money, restrict the money supply and lower the credit growth, but this is not advisable for a growing economy like India as:

- Businessmen will not invest in expansion or growth.

- People will start saving instead of spending.

- The economy will not grow and most activities may come to a stand-still.

For the economy to grow, the loan growth (credit growth) has to be positive, the loan rates (credit rates) have to be low and the labor market has to be cheap. For this to happen the central bank (RBI) has to be in an expansionary stance and the money supply in the country has to go up.

When such a policy stance is followed, inflation is expected to go up. RBI has set a range wherein 4% is the lower band and 6% is the higher band for annual inflation.

Most people do not realize having a 6% annual inflation in itself is dangerous, our FY24 GDP growth rate is estimated at 7%. On a net-to-net basis, our effective growth rate will only be 7–6 = 1% per year.

Let me illustrate how Inflation is the silent killer and how most of your dreams and goals are going to be shattered.

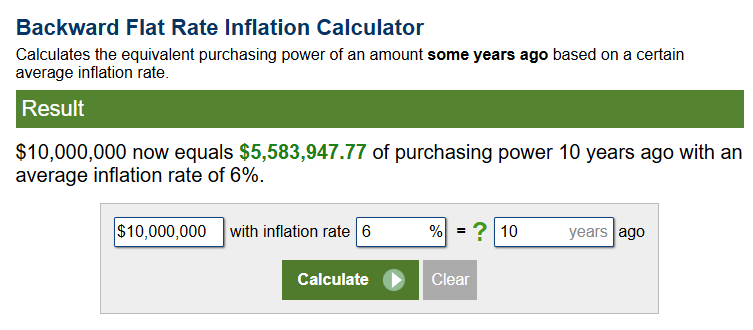

Example 1: Your current bank balance is 1,00,00,000 (10 million rupees). At an annual inflation of 6%, you will be left with 41,72,650 (4.17 million) at the end of 15 years.

Replace $ with ₹

Example 2: If the period is 30 years, you will end up with 17,41,101 (1.74 million) if you have a 1 crore bank balance.

Example 3: If the period is 10 years, you will end up with 55,83,947 (5.58 million) if you have a 1 crore bank balance.

These calculators may look scary, but the reality is scarier. The inflation for a few verticals like healthcare, education, travel, and rentals is much higher than 6%. A higher inflation would ensure your funds are depleting faster.

There is only 1 antidote to Inflation and that is to build assets. Not any asset, but the ones that have an annual growth rate higher than the inflation percentage.

Inflation is the biggest nightmare for the current NDA government 2013-present. Two events made me conclude that the current government has lost its fight against inflation and foresees a tax base erosion due to the same. These 2 events are:

- Removal of LTCG (long term capital tax gain) indexation benefits on Debt Mutual Funds in 2023 — source.

- Removal of Indexation benefits on the Real estate sector in 2024 — source.

The common factor for the above 2 points is Inflation. Both debt funds and real estate sector enjoyed Indexation benefits all this while. I shall explain the indexation benefit in a separate article, but the summary is: when the long term capital gains taxation is calculated for the debt mutual fund or the property, there was a clause to deduct the erosion caused by inflation.

For example, if your capital gains were 15% CAGR whereas the cost inflation index (CII) showed the inflation was 5% during the same period, then the net gains would be 15–5 = 10%. Now that it is removed, you will end up paying LTCG for the entire 15% gains.

If inflation is not checked, and it goes up to 7% or 8% and the real economy growth rate is negative — then it means a severe loss in tax revenue base. By removing the indexation benefits, the Govt. will continue to get its fair share of revenue even if the end user is suffering.

If you liked this content, consider sharing it with your friends & relatives..

Calculators are for illustrations only and do not represent actual returns.

Mutual Fund investments are subject to market risks; read all scheme-related documents carefully.