The curious case of Jio Financial Services | Disruptions in Broking Soon?

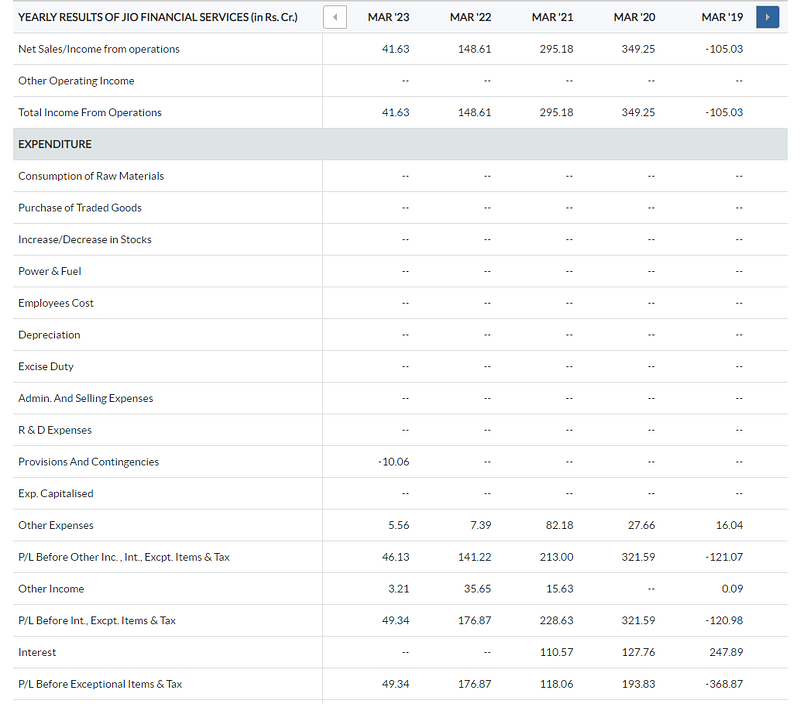

How did Jio Financials which had a net income of 41.63 crore by March 2023 manage to list at a 1.66 lakh crore market cap?

The answer might lie in the name “JIO”. Most of the shareholders would have been carried away by the 1:1 RELIANCE shares demerger event. It was even presented as a buy 1 get 1 free share program (Buy RELIANCE, GET JIOFIN free). Most of them would have thought JIO means the telecom, internet, and all the ecosystem that goes with it. Actually it’s NOT.

During the COVID lockdown, we all saw how investors flocked into RELIANCE JIO on one side and then the RELIANCE RETAIL on the other. In those 3 to 6 months, we had no movies nor the IPL, but these news events were more entertaining than them for sure. I kept the television on with the CNBC-TV18 channel (owned by RELIANCE) and then saw these colorful investor additions with much interest.

2 things that happened

- RELIANCE renames RELIANCE STRATEGIC INVESTMENTS LTD to JIO FINANCIALS.

- Announced the Demerger of JIO FINANCIALS ahead of JIO or Reliance Retail

Most of the retail traders and investors would not have seen or heard the first news but definitely not missed the second. I still assume many of them would have thought JIOFIN is actually a JIO Telecom company.

Why would a company not announce the demerger of JIO-telecom or Reliance-Retail ahead of Jio-Financials? During their annual shareholder meeting — wasn’t that the plan?

Lets look at the numbers & facts too.

2. Scheme of arrangement & Disclosure

Revenue Data

This firm has managed to command a Mcap of 1.6 lakh crore. Read here which means much higher than the firms like Mindtree, Tata Steel, Coal India, Hindustan Zinc, Bajaj Auto, Siemens and Indian Oil. Come again — what was the annual sales of Jio Fin??

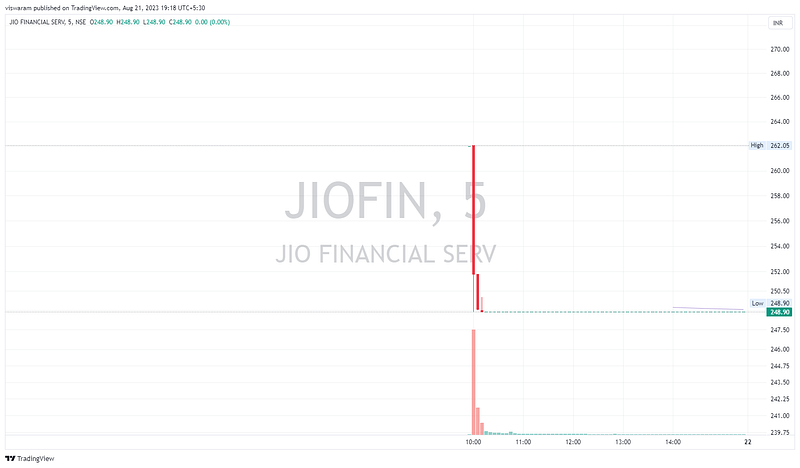

Their listing on the exchange today was nothing short of DRAMA. It came with a 5% circuit limit plus a ban on intraday & BTST trades (sebi). Guess how much it fell today — just 5%.

The future holds promise though

“BlackRock and Jio Financial Services Agree to Form Joint Venture to Enter India’s Asset Management Industry” read here. Blackrock which is the world’s largest asset manager with USD 8.59 trillion AUM (wikipedia). Most often this company has more power than the founders who seeked investments for their firm. Blackrock had tie up with DSP earlier and they quit (economic times).

Now RELIANCE has set a precedent of disrupting the sector it is venturing into. We saw that in telecom, and retail.

See my tweet in Apr 2022

Now that they have decided to launch an AMC with 1:1 ratio with Blackrock, not just the mutual fund industry gets disrupted. The brokerage houses also could face the heat. All JIOFIN has to do is start a brokerage firm and provide free broking services for a year to drive all other competitors to bankruptcy.

Even better would be to buy out any or all of these private players and get a headstart with strong “Active Clients”. I am assuming the Top 10 players will not be interested to sell their assets whereas the next 10 would be — considering they will be the first to go if JIOFIN jumps in.

So even though the valuation of 1.66 lakh crore looks pretty huge at present, the fundamentals may catch up soon.

I will keep this article open-ended (not like the mutual fund open-ended scheme 😉) but to track the developments in this space.

You can reach me @viswaram on Twitter/LinkedIn for comments.