27 Feb ’24 — Nifty fights it out and resolves on the upside — Nifty & BankNifty PostMortem Analysis

Nifty Analysis — Stance Bullish ⬆️

Recap from yesterday: “Ideally, we should expect the leg2 to start soon, but the premiums are not indicative. Also, we have the monthly expiry this week and things could get a bit volatile before we find a clear trend.”

Nifty50 would have given enough choppiness for those bullish today to test your courage. But N50 ended up defending yesterday’s low and resolved on the upside. We started the day gap-down, but we did not have enough momentum to break the swing low. And by the 3rd candle, we went into the green territory. From there we had one more attempt to go underwater i.e. from 11.39 to 12.11 — but this attempt was quickly bought into. Interestingly, N50 took this as the reversal point and then started climbing steadily. On the 4 minutes chart, it formed a nice 2-legged upmove.

On the higher time frame, the ATH is the only thing that stands in the way of the Bulls. Whereas, Bears have 2 to 3 tasks to do to get the scale tipped in their favor. They need to take out the 22051 and 21913 support levels, which is only possible if we have a macro level bad news. Banks are the only sector that could give away such an opportunity. Already the FIIs are not so happy with the future prospects of the financial sector in India. A small trigger could set the ball rolling and before long it could become an avalanche. What we can do is wait for more clarity to appear and then play along. As of now, we wish to play bullish on Nifty and neutral on BankNifty.

BankNifty Analysis — Stance Neutral ➡️

BankNifty is still managing to stay below the bearish trend top line and that means we are in the bearish channel as of now. You might wonder if we are in the bearish channel — why is our stance still neutral? The answer is that, even though we have entered the bearish channel, BN has not shown any signs of breakdown. We are still knocking the resistance level and trying to keep up with Nift50’s direction.

Over the last 2 months, most of my directional bets have gone awkwardly wrong. On investigation, I came to know that it is because of NiftyIT. The level of uncertainty and the swing range of IT stocks are really taking a toll on the stability of Nifty50. Either we need to have FnO enabled on NiftyIT so that we can hedge and tide over the problems it is causing or the Banks have to take charge and cast them out.

On the higher timeframe, BN is still following the double-top pattern with the trades being conducted in the bearish channel. To go bullish, BN has to reclaim the 47465 resistance whereas to go bearish all it has to do is just fall another 650 to 700 points. We wish to look out of neutral trades till the directional clues emerge.

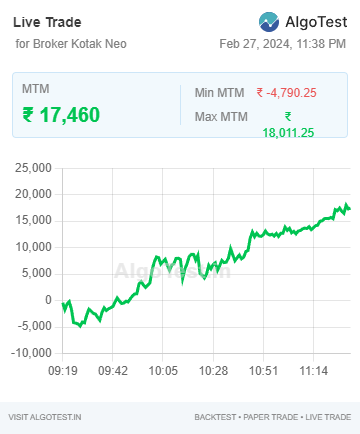

Algo Trading

Our algo trades ended today with a gain of 17460. We closed the trades prematurely as 85% of the day’s target was hit within 11.29 and did not want to risk the lead.

· Intraday Algos run via AlgoTest on Kotak

· Webhooks automation run via TradingView on Dhan