21 Feb ’24 — First Real Threat for Bulls Today — Nifty & BankNifty PostMortem Analysis

Nifty Analysis — Stance Neutral ➡️

Recap from yesterday: “On the 63mts TF, N50 is still looking strong — we would keep our first support level(weak) at 22051 and the main support at 21913.”

Bulls were roaring and seemed like the entire territory was under their control and then suddenly from nowhere, we got a flash crash. Nifty50 hits a new ATH of 22249 and then falls 252 points ~ 1.13%. Yesterday we talked about the shallow support at 22051, it was interesting to see the 14.39 RED candle just did not respect that level and fell aggressively. After hitting a low of 21997 we had a pullback of 101 points, but that got sold into. The closing was strongly in favor of the Bears.

Technically Nify50 has just fallen 141 points ~ 0.64% and even after that, it is still bullish on the higher timeframes. We need to really find out what was the reason we had a flash crash today — it did not feel like a profit-booking stunt. It appeared more like a news/event released to a selected few participants. Since Nifty50 fell below our support line, we had to reverse the stance back to neutral. In case Nifty50 climbs back up tomorrow and hits a new ATH, today’s move will just appear as a blip, and the stance will go back to bullish.

On the higher timeframe, Nifty is below the 22051 resistance and above the strong support of 21913. If the Bears are planning for another attack tomorrow just like the one we had today — then we strongly feel that the 21913 level should be tested and even broken. Ideally, the opening 1st & 2nd candles will give away the directional trend. Interestingly, BankNifty did not participate in the downward trend today, most likely it may be attributed to the expiry and the aggressive positions taken by the smart money. Anyway, we will get to know by tomorrow if the Bears are back or not.

BankNifty Analysis — Stance Bullish ⬆️

Although BankNifty created a double top (M pattern) on the 4 mts time frame today, the stance is still bullish. The reason we did not change the stance for BN even though we downgraded N50 was that BN did not even test the support level today. Despite the selling pressure on all other counters, the Banks did not attempt to re-enter the bearish channel nor break the trendline. Ideally, it had to fall below 46833 to go into a bearish zone and today’s low was 46886. We know a 50pts margin is not that adequate, but when we switch to a higher time frame chart — you may agree with us.

If you look at the chart below, even after adjacent RED candles, BN is still above the blue trend line. Tomorrow’s opening 63 minutes is very crucial as the major reason why BN did not participate in the fall today could be attributed to expiry day trades. When the selling came, the volumes of the top 4 banks had spiked accidentally revealing that it could be the start of something big. We guess the torch-bearer status of BankNifty has to be kept on the back burner as NiftyIT is calling the shots now. February is proving to be equally volatile as January 2024. Both the indices are now hunting for the stop losses and it seems like the ATM non-directional traders are going through another drawdown phase.

For tomorrow we wish to start the day with a bullish bias and not get into any aggressive bets. Will wait for the first 63mts candle to appear and then take things from there. If we stay below the blue trend line — the status would be changed to neutral immediately.

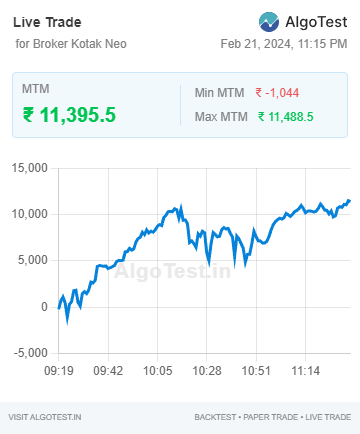

Algo Trading

Our algo trades ended today with gains of 11395. We booked the profits early i.e. by 11.34. Would have to backtest and find out tomorrow if our decision to prematurely exit was worth it or not. Yesterday also we exited prematurely and the backtests proved we made the right choice.

· Intraday Algos run via AlgoTest on Kotak

· Webhooks automation run via TradingView on Dhan