16 Feb ’24 — Nifty stance upgraded to Bullish, BN Neutral — Nifty & BankNifty PostMortem Analysis

Nifty Analysis — Stance Bullish ⬆️

We all knew it would be a gap-up today and see how the bears ran for cover when we opened 93 points ~ 0.43% above yesterday’s close. The spike in CALL premiums was enough to show the fear of short covering. Secondly, there was no attempt to close the gap — which would have left the Bears with no choice but to abandon their short position or roll over to the next week and find a similarly priced strike. Fortunately, most would not have made a heavy loss as the “real breakout” did not happen today. Nifty was just contented to hold the ground and not concede the territory.

After the first 63-minute candle we revised our stance to bullish, if you have read our last few reports — you would understand the rationale too. See the island formed above the resistance level of 21913. It is a classic breakout formation. From 15th Dec 2023 to 15th Feb 2024 — Nifty was in a narrow range of 21491 to 21913 with a couple of false breakouts/breakdowns. So we are keeping our fingers crossed this time to validate whether it works out. One way to do that is to check for follow-through price action. Blips do not last that long and we usually fall below the resistance (just like what happened on the last 2 occasions). Today is the first time I guess Nifty made the move ahead of BankNifty for a direction change. BankNifty has a lot of headroom left and if it catches up to its ATH — the impact on Nifty is going to be more than awesome.

BankNifty Analysis — Stance Neutral ➡️

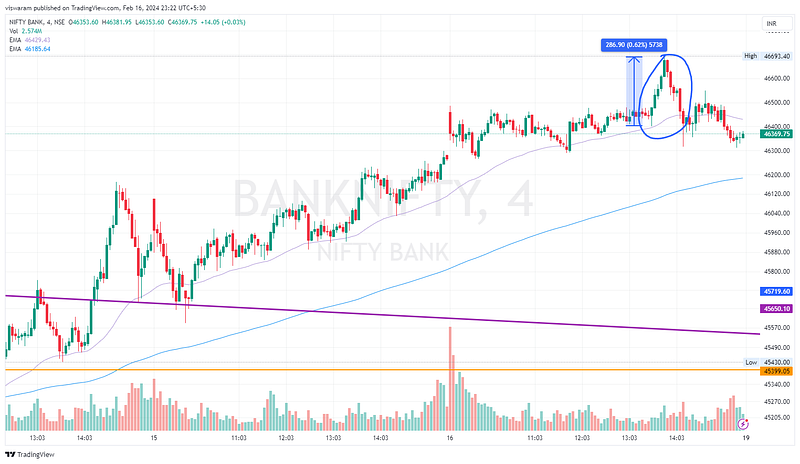

The move BankNifty made did not correlate with Nifty50 today. BN’s gap-up was sold into and then we recovered once the gap was closed. Yes, there was no selling pressure which was common to both. The straddles on BN were progressing better than expected when we had a quick surge and an equivalent fall between 13.31 and 14.11. We assume it may be connected with a news/event that broke about Paytm & selection of any of the banks for its payment settlements.

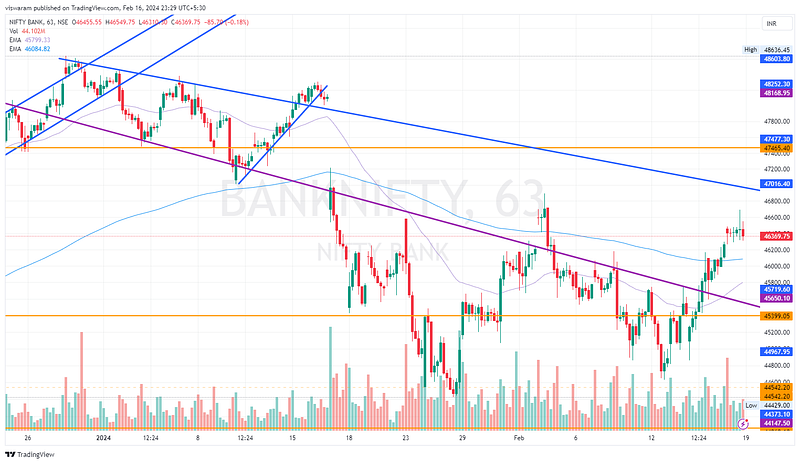

On the higher timeframe, you can notice how BN is making progress to its next resistance level of 47465. Since it is inside a descending (but not parallel) channel, it need not even break the resistance for a stance revision to bullish. All it has to do is take out the 47016 levels soon and break the upper end of the channel. Since Nifty50 has made its intention clear to go long, BankNifty willingly or not would have to support that cause. We wish to maintain the neutral stance till then and go bullish as and when the conditions specified are fulfilled.

Algo Trading

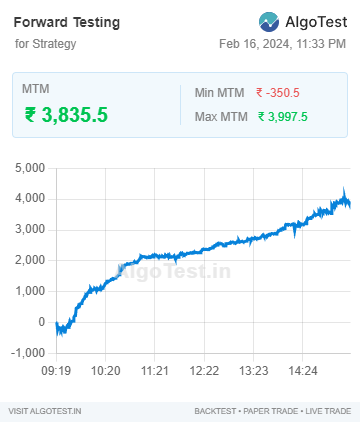

Our BankNifty algo trades ended today with a gain of 3835 points.

· Intraday Algos run via AlgoTest on Kotak

· Webhooks automation run via TradingView on Dhan