05 Feb ’24 — A Sharp Fall from the Support Level — Nifty & BankNifty PostMortem Analysis

Nifty Analysis — Stance Neutral ➡️

The 21913 support and resistance line was in play today and for most of the time, Nifty50 was trading above it. The start of the day was quite tricky though — we opened gap-up right at this SR level and then fell to the previous close. In the next 8 minutes, we are back above the SR line. Although the price action was flat, we felt the chances to break out were higher than a breakdown. But the reverse happened — from 14.03 to 14.43 Nifty lost a whopping 216pts ~ 0.99% and never recovered from that fall till close. This makes us wonder — what the reasons could be. Rumors broke out that RELIANCE may be interested in buying out the wallet business from PAYTM. Since PAYTM was in a lower circuit throughout the day, the results were felt on the RELIANCE stock. It started falling. But this is not contagious — why would the other stocks react to this?

The next support comes at 21491, which is quite a long distance. The chart pattern is not at all bearish, in fact, it is more bullish than bearish. But we all know for an upward move, the resistance has to be knocked out whereas the support has to be breached for a downward move. For tomorrow, we wish to maintain our neutral stance and wait for some directional clues to appear.

BankNifty Analysis — Stance Neutral ➡️

BankNifty was more flattish today even though the chart pattern shows a bearish tinge. We lost 145pts ~ 0.32% today, but if a trader got into a straddle position after the first candle — it would have ended quite perfectly today. This means that the net loss for the banknifty was decided in the opening 4 or 5 minutes and the remainder of the day was just spent fooling around.

If we extrapolate it from the previous day’s pattern it looks bearish. But if we extend it to the last few days — it’s all neutral. As long as BN is between 45399 and 47465 — we are in for a perfect range-bound trade. The moment one of them gives away — we can see the pressure releasing and a strong trend developing. We need to note that Nifty was unable to break from a range-based trade in the last 47 days, as the count of the days goes up — the higher will be the breakout/breakdown momentum.

Most importantly BankNifty will have to be its torch bearer. Looking at the charts right now — BN is pretty unsure which way to swing. There were some bright RED candles in the last 3 week’s action and possibly things are facing south. Whereas Nifty is looking northbound. As long as this tug-of-war stays, none of them breaks free. The best option for the bears is to take out the support of 45399 via gap-down tomorrow and then hope the shorts will mount. We wish to maintain our neutral stance till something materializes.

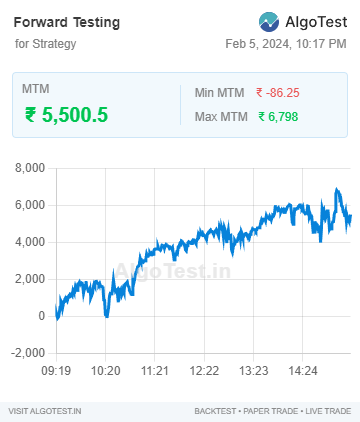

Our BankNifty algo trades ended today with a gain of Rs5500