01 Feb & 31 Jan ’24 — Nifty Not in a Hurry to Go Anywhere YET — Nifty & BankNifty PostMortem…

I was not able to post the report yesterday as got a severe headache and fever. After closing my screen at 15.30 yesterday, got enough strength to open it today morning at 07.46. Seems like the analysis of Tuesday was more or less true even for today as Nifty and BankNifty went nowhere. The Budget 2024 was a 1hr speech, but it had no major changes — it looked like more of a reform package. India being a developed country by 2047, I seriously cannot understand the relevance it had in the next year’s budget. The sad part is most of us may not be alive 23 years from now. I thought the budget was to outline what is going to happen in the next 12 to 15 months.

Nifty Analysis — Stance Neutral ➡️

Nifty has made a double top-like pattern of which the bottom 2 points were right at the support line of 21491. That means — we cannot say with confidence if the next move will be bullish or bearish. We were all expecting Nifty to pick up a direction today after the budget announcement and since that did not happen — we may have to wait for further triggers. We would prefer to stay neutral till then.

Due to the Budget event, the premiums on both Nifty and BankNifty were crazy today morning and only cooled off 90mts post the start. We are quite sure most of the traders would have minted a fair share of money today as whichever OTM strike you chose today, had 2x to 10x unusual juice today. So even if you did not hold till 0, you would have ended up in GREEN. The only issue was for option buyers who would have expected a directional trend today — they would have gone home seeing their strike decaying value for no reason.

Between the last expiry and today, Nifty has gained 317pts ~ 1.48%. Most importantly it has crossed 1 support level of 21491. Another interesting part is the open on Jan 01 was 21732 and the close today is 21697 which means for an entire month Nifty has moved less than 35pts. This also means the kind of amount non-directional traders would have minted this month and the plight of directional and trend followers. Staying in a nondirectional path also means consolidation. Bulls and Bears are reevaluating their army strength and will soon fight it out — we will get a trending move as soon as the balance is tipped. For tomorrow — we wish to start the day with a neutral stance and then re-evaluate based on Nifty’s plans. If we pick a direction, we will definitely update the TV minds section.

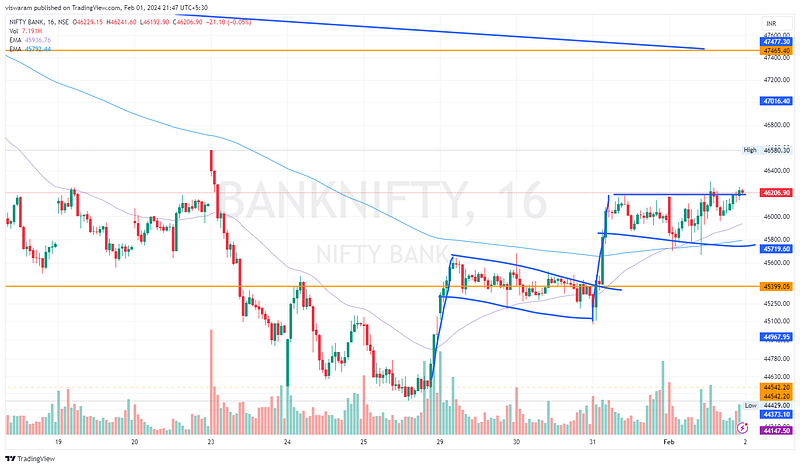

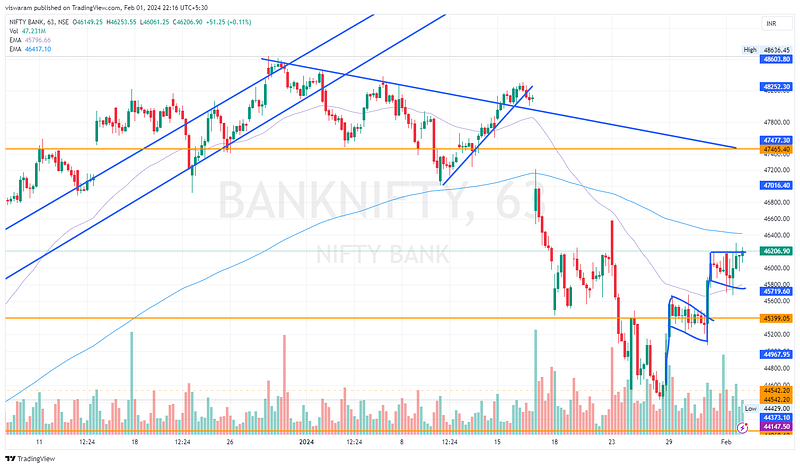

BankNifty Analysis — Stance Neutral ➡️

BankNifty has made some interesting patterns on the 16mts TF. It looks like BN made quick surges to a specific price level and then cooled off softly. Much like a mini-flag pattern. BankNifty may be showing signs of going up if that is the case. We can only confirm if the next resistance of 47465 is broken — and if that happens tomorrow, then the game is set.

The biggest issue is the kind of selling the banks had from the FII’s basket. That factor is still haunting BankNifty pretty badly. The depth of the RED candles proves that point. When we have selling of that sort, we would need a strong response from the domestic buyers to go up. Meanwhile, if the DIIs are stalling — we may see further price corrections from here.

BankNifty is the go-to leader for directional trends, it should hold good in the current situation also. First, the BN has to move clearly in a direction, most likely Nifty will follow. BN still holds 38% of the weight on Nifty. For tomorrow we would like to start with a neutral stance and then adapt if Banks show some traction.