28th Dec ’23 — New ATH on the last day of the Quarter — PostMortem on Nifty & BankNifty

Nifty Quarterly Analysis

Nifty has gained 2263pts ~ 11.6% in the 3rd Quarter of FY2023–24. Almost on 9 particular days, we hit new all-time highs.

1D chart link — click here

Nifty Monthly Analysis

Surprisingly 70% of the gains for the Q3 came in the December series. We rose 8.21% ~ 1653pts. 8 out of the 9 ATH breaks also came in the Dec series. It really was a December to remember for the bulls.

1D chart link — click here

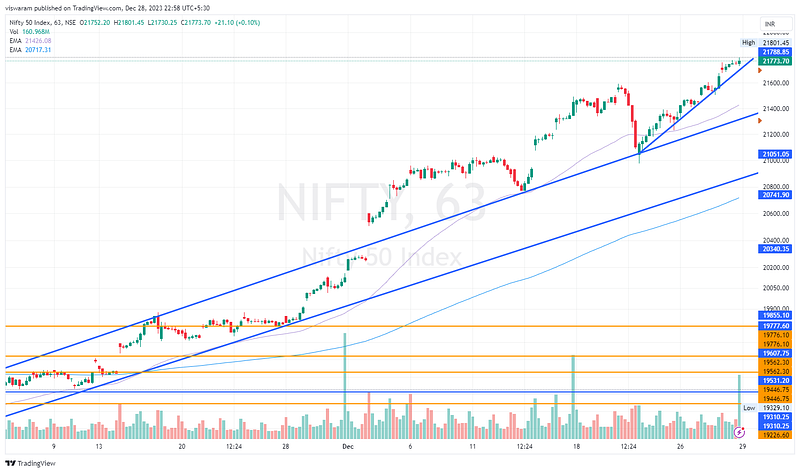

Nifty Analysis

4mts chart link — click here

On the last day of the month and Q3, Nifty makes a new all-time high of 21801. So the magic level of 21800 is conquered. Guessing most of the buying would have been propelled by the FIIs and that too after 14.59. India VIX went over 16% but ended the day at 15.14. I feel like the Bears have lost control of the situation here, not just that they can check the bull runs but are ceding territory far too easily.

Investors really love bull markets, their portfolio grows greener day by day. But from a trading perspective, a high level of euphoria is dangerous. The CALL options of the 04 Jan series were trading 25 to 40% higher than usual rates. The collapse of this excess in the last 15mts would have taken many traders by surprise. When we place market orders — we seldom realize the “fair value” of strikes.

63mts chart link- click here

Nifty is definitely on cloud 9, the newfound momentum is intact and almost all the sectorial indices are strong. What next? Is a big question. Just like a goods train, it is difficult to stop the bull run that fast. Global markets are also at all-time-high levels and the macros are improving. For tomorrow, I wish to continue my bullish stance with the first support level at 21652.

BankNifty Quarterly Analysis

Surprisingly BankNifty rose only 9.56% ~ 4232pts compared to 11.6% by Nifty. There are 2 reasons for this.

- RBI’s I-CRR and CAR weight adjustments decisions rocked the boat and BN fell much more than N50

- NiftyIT rose to the occasion and supported N50, in the same period NiftyIT gained almost 12%

1D chart link — click here

BankNifty Monthly Analysis

94% of the Quarterly gains came in the December series alone. It was like a relay race and during the last lap, BN ran so fast that it made up for the losses in the earlier 2 months.

1D chart link — click here

BankNifty Analysis

The gap up really helped BankNifty to cross the top boundary of the ascending channel. After that happened, all BN had to do today was to resist falling below that inclined support level. In fact BN did that beautifully today and in the process hit a new ATH of 48636.

4mts chart link — click here

The monthly options expiry is much better than the weekly ones. Primarily because the premiums are pretty high when Nifty and BankNifty have expiry on the same day. From a trader’s perspective, the earnings are directly proportional to the premiums the strike carries. During volatile expiries like today, the premium is too sugary to resist.

63mts chart link — click here

BN trade above the ascending channel top line is not that clear from the chart as the line is seen as cutting it through. On a lower TF, you can clearly see the difference. For tomorrow also, we are going with the bullish stance.