18th Dec ’23 — Our market takes a pause — PostMortem on Nifty & BankNifty

Nifty Analysis

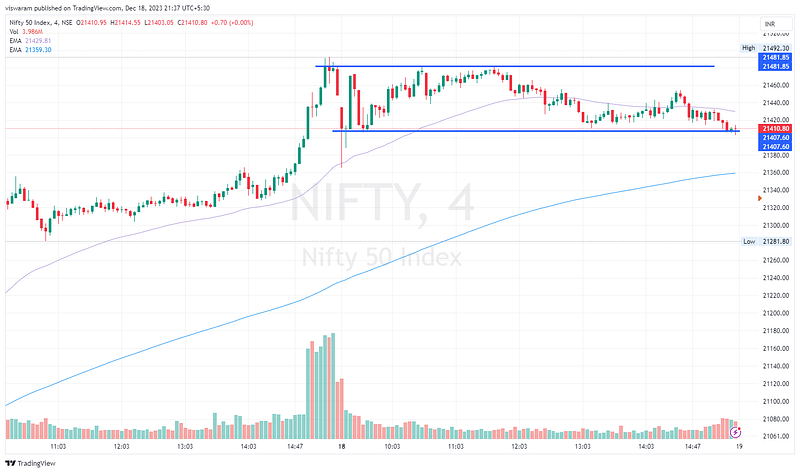

Recap from yesterday: “My stance continues to be bullish with the first support level revised to 21341. All we can do now is trail the stop loss and let the winners run.

4mts chart link — click here

Nifty was absolutely trading in a narrow range with minor dips. More action was visible on BankNifty today which nudged me to go for a status change (will discuss this shortly). Nifty opened gap-down — the excess euphoria of Friday got shaved off and then it recovered from the LOD. Interestingly the low of the day was in the opening minutes and we never tested it. Technically 21341 was not tested and no status change is warranted.

63mts chart link — click here

There was nothing special in today’s action. Nifty defended its lower side quite neatly. NiftyIT was toggling between red and green. BankNifty was in RED. Nifty Pharma was quite energetic today, but the major point gainers for Nifty were RELIANCE and Bajaj Finance. I do not wish to change Nifty’s stance — I still prefer to look for long-only trades. However, 21341 would be the laxman rekha for me tomorrow also. If we get a closing below that — I would love to go neutral. To go bearish — we need to break below the upper boundary of the ascending channel.

BankNifty Analysis

We got some interesting moves today by BankNifty. During pre-open ICICI bank was looking very weak but other banks were looking okay. But once markets opened — BN fell to 47810 by 09.19. The 2 horizontal blue lines I have drawn are the weak support and resistance lines from the last 2 days of action. BN went above the 47873 and was trading above that for most of the time.

4mts chart link — click here

We got one hit at 13.11 and the 2nd one by 14.43. After the 2nd hit, BN briefly fell below the support level and the final closing was at 47862. The LOD was broken 15.23 — so it is like we closed into weakness. The distance to my target of 47754 remained at just 52pts. And that is the main reason why I prefer to change my stance from long to neutral for tomorrow.

63 mts chart link — click here

If BN builds back momentum by tomorrow afternoon (FinNifty’s expiry could help), then it has to take out the ATH — only then I would prefer to switch back to bullish mode. To go bearish, the first step BN has to do is take out the top boundary of the ascending channel pretty quickly.