13th Nov ’23 — What went up during Diwali, came down equally — PostMortem on Nifty & BankNifty

Nifty Analysis

On the 5mts TF, I have encircled 3 regions.

- The close on Friday.

- The Diwali Muhurat trading on Sunday.

- The close of today.

Sunday’s trade appears to be a blip. Just like the fireworks that we light on Diwali — they go up, illuminate, and then fall back to the ground. Our market was like that rocket on Sunday. A mega gap up, island day formation, and then back to earth after today’s close. Even I did not anticipate the neutral call to work out so perfectly.

Few things have changed after today’s price action. 19446 support/resistance is proving to be more important than thought earlier. Today between 10.05 to 10.20, I really thought we would break it for the greater good and go back to bearish mode. Unfortunately, all the action stopped after the first hour of trade today and we were perfectly directionless for the remainder of the day.

On the 1hr chart, today’s 2nd hourly candle stands out. It broke through the 19446 support but failed to gather steam. The depth of that candle should not be taken lightly, I am seriously considering looking out for bearish opportunities as they uncover. Since its a holiday tomorrow, the view for Wednesday could be a bit complicated. Ideally, I wish to maintain the neutral stance as nothing has changed but how SPX behaves today and tomorrow also has to be considered.

The first checkbox to tick is a rising VIX, only then a down move can be justified. The options premiums as it stands are not worth selling. A bit of uncertainty and panic will drive up the premiums & I am ready to wait.

BankNifty Analysis

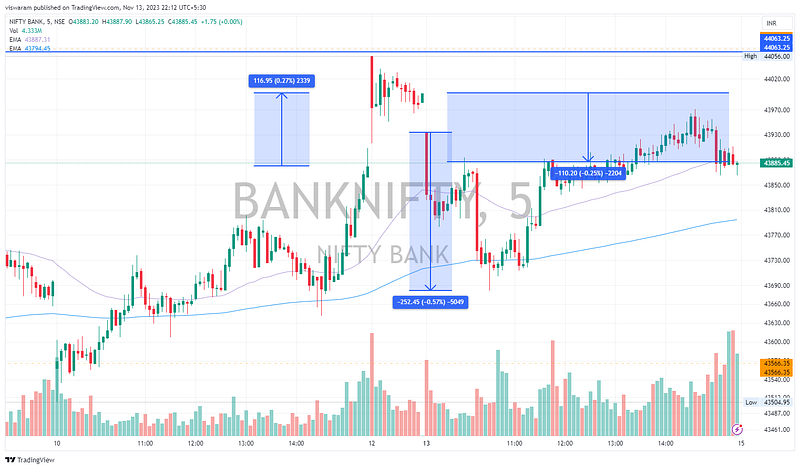

Banknifty also erased the gains it made on Diwali Mahurat trading. Today’s close is almost at the same level as of 10th Nov. Interestingly BN tested the resistance of 44063 on Sunday from where it was rejected.

Sunday’s trade could be thought of as manipulated (legally) as most of them come with a bullish bias for Muhurat trades. Few of them deploy their Diwali corpus on stocks, etf, gold etc. But today’s initial price moves suggest the sellers are not done yet. After opening gap down, we went another 252pts lower and then climbed back — just like a warning shot.

But BankNifty recovered much more elegantly compared with Nifty. By 14.35 we almost closed the gap.

There are 2 ways to look at the ascending channel. Either it’s a strong breakout candidate or it may be a downward flag consolidation phase on a weekly time frame. The only way to confirm is to wait for clarity. If it’s an upmove, 44063 has to be taken out immediately. If we are staying as it is or dipping, the bears will take it up from here. For Wednesday, I wish to maintain my neutral stance till one of these levels gets broken (44063, 43566).