2nd Nov ’23 — When NEWS flows, technical analysis goes for a spin — PostMortem on Nifty & BankNifty

Nifty Weekly Expiry Analysis

Between the last expiry and today, Nifty has accumulated 299pts ~ 1.59% points. Most importantly it has broken away from the crucial support of 18880. As it stands Nifty is below the resistance of 19310 — but with the momentum it has gathered, seems like it will get tested this weekly series.

Nifty Today’s Analysis

Nifty opens today with a gap up of 138pts ~ 0.73%, rallies to 19175 by 09.40. This was totally sponsored by the FED with its FOMC decision & the commentary that followed. Markets in the US got the feeling that this was going to be the last of the hikes and were overjoyed.

We need to get some background on this topic to understand the real impact. Even if the FED says no more hikes, it doesnt mean the rate cuts will begin soon. If the rates are held at this 5.25 to 5.5% for longer — there is nothing bearish like that. So the reaction that is seen now could just be a temporary phenomenon. The longer FED keeps the rates high — the higher the money that will get sucked out of equity. Also, watch the small and medium-scale businesses — they are the first to go under when the cost of borrowing stays high. No, I am not spoiling the bullish party — I am just being practical.

Coming back to India, RBI cannot cut rates when the US holds its line. If we do, more money will flow out from India, further depreciating INR. If RBI also holds the rate at this level long enough — our SME universe will also be impacted.

On the 1hr TF, Nifty has formed an island today. The 3rd hourly candle was quite RED — but the fall was arrested soon enough. The levels have not changed from yesterday, the first resistance is at 19226 and the 2nd one is at 19310. I am staying neutral till 19226 is not taken out, seems like it could be even done in the forenoon session. Visit my tradingview minds section, for updates during trading hours tomorrow.

BankNifty Analysis

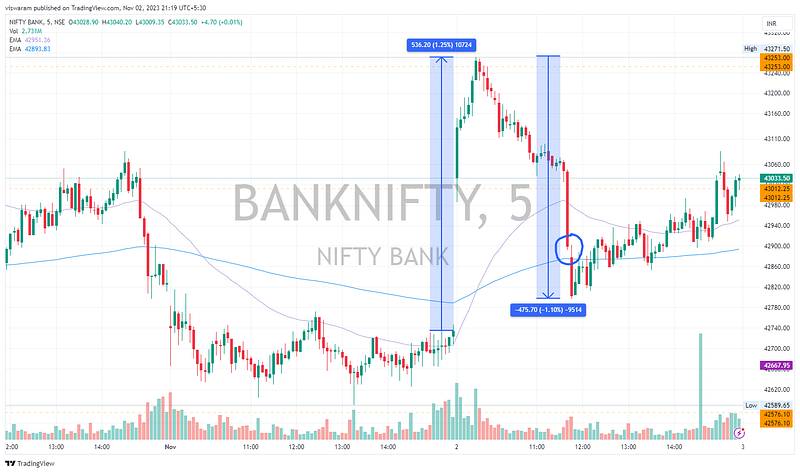

BankNifty had a unique day today, firstly a gap up open and a total swing of +536pts ~ 1.25% with respect to yesterday’s close. We were not able to take out the 43253 resistance and its rejection resulted in a deep fall of 475pts ~ 1.1%. Cant believe we even had a falling window candle stick pattern between 11.40 & 11.45.

Seeing the fall, I was quite confident that the gap would be closed and soon we would take out the support level of 42576. Another day has gone worthless for the PUT options. I am still not sure how BankNifty stopped falling right at 11.50. For me, the red candle at 11.40 came right at the support level of 43012 and the break should have resulted in further momentum.

In any case, BankNifty climbed back to the SR level and closed just above 43012 to give the illusion of bullishness to the market participants. I am still not convinced entirely, but seeing the global markets overflowing with euphoria — seems like we will take out 2 resistances tomorrow.

The levels to watch out for are 43253 and 43404 on the upside and 43012 and 42576 on the downside.