31st Oct ’23 — Unusual Opening 5mts Candle — PostMortem on Nifty & BankNifty

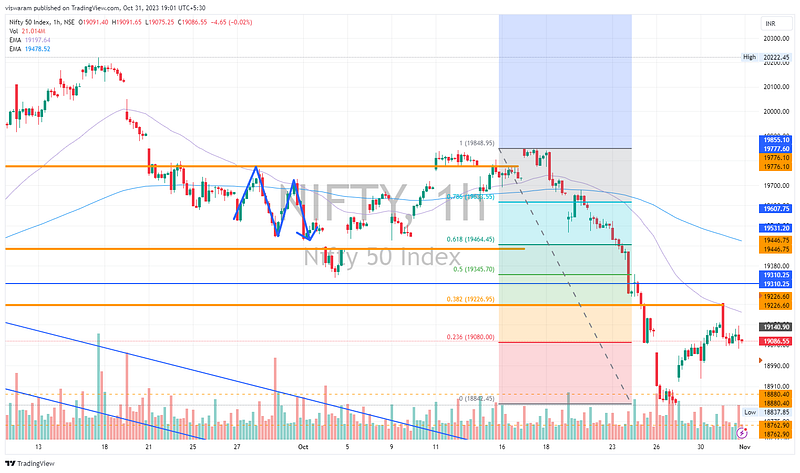

Nifty Analysis

The open (19233.7) was quite strange, a mega gap up right at the resistance level of 19226. If we had gone further up from there, I would have definitely changed my stance from neutral to bullish. Instead, we started falling. The gap was closed in 10mts and we went further south. By 10.40 we lost almost 168pts ~ 0.88%. Fortunately for the bulls, the fall stopped right there, even the close of the day was around those levels.

From 27th Oct I had a neutral call on Nifty50. Nifty closed at 19060 then, it is at 19086 today. Connecting the dots, what I still feel is we are waiting for the bearish momentum to pick up. A look at the 1hr TF with the Fibonacci levels will cement this thought.

Since we retraced the 38.2% level of 19226 today and the reluctance to go up might be confidence-building for the bears. Also the 23.6% level forms a base for further movements. The issue is that we cannot go outright bearish now, we need further proof of that. Ideally, the 18880 support has to be taken out and that too pretty quickly. Till then I wish to maintain my neutral stance.

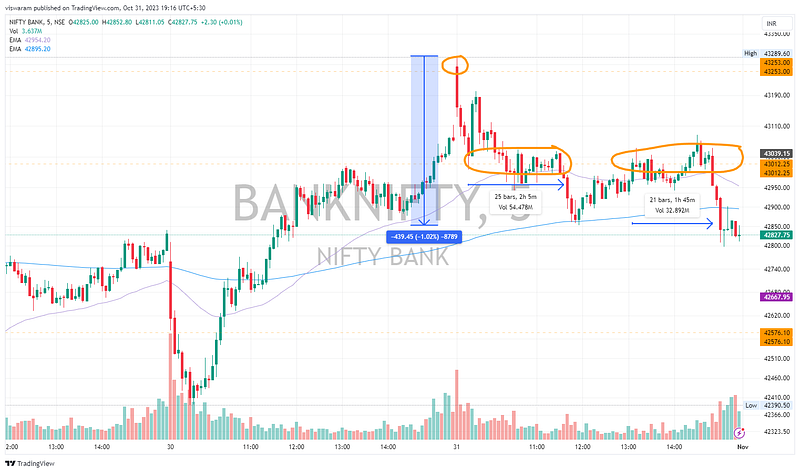

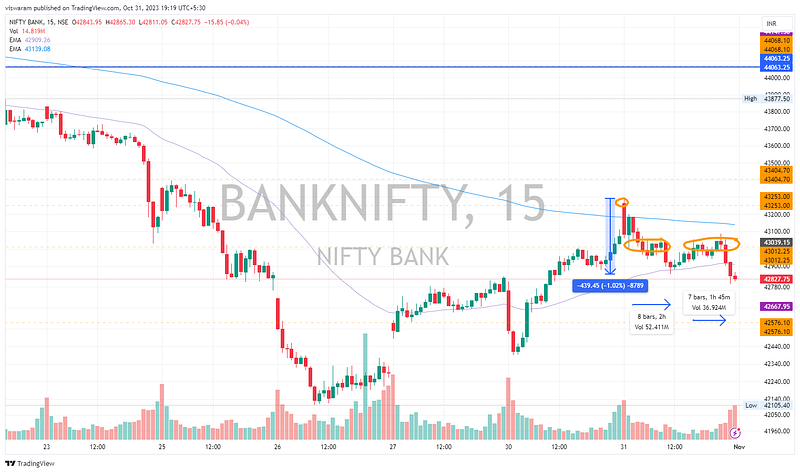

BankNifty Analysis

Further clues for Nifty50’s movement might be hidden in BankNifty’s price action. Unlike Nifty, BankNifty has crowded support & resistance lines nearby that may impact the trend movement. The only way out is to come up with a big RED or GREEN candle break the support/resistance and ensure the momentum picks up.

The open (43264) was around the resistance level of 43253. We had a rejection in the opening candle itself. The first pause was at the support level of 43012 which was hit by 09.30. From 09.30 to 11.35, Banknifty was stuck in this zone.

At 11.40, I thought the 2nd leg of the down move may be building up — but it was a false flag. BankNifty managed to crawl back to the resistance of 43012 by 13.05. It spent the next 1hr 45mts in this SR zone.

Interestingly the price action from 14.50 to 15.00 (3 candles) was very interesting. I still think the clue for the next big move is hidden in this. Why do you think we had that move otherwise?

We are exactly at the same level as of 27th October. For the last 3 days, I have maintained the neutral call and somehow the markets are kind of obliging. If 42576 gets broken tomorrow, I will be highly excited to look for shorting opportunities. Since it is the weekly expiry tomorrow, I hope we can get some deep price movements.