12th Oct ’23 — A perfect Flat day of trade — PostMortem on Nifty & BankNifty

Nifty Weekly Expiry Analysis

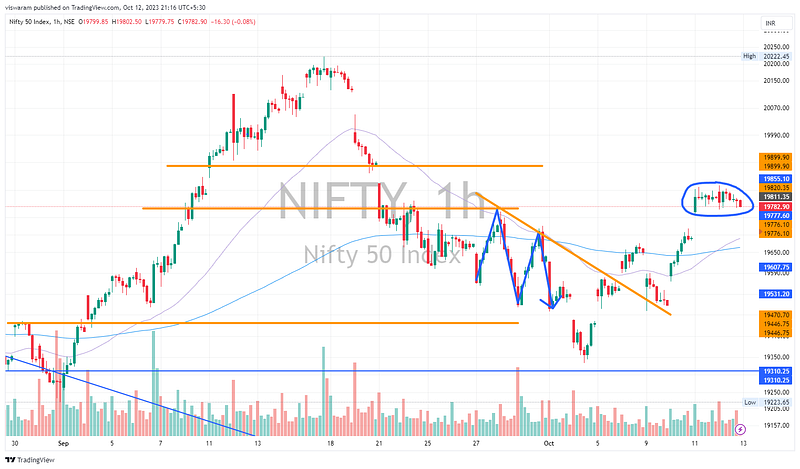

Nifty went up 236pts ~ 1.21% between the last expiry and today. The major highlight was its capability to defend the support of 19446 and then breach the resistance of 19776. Today we even retested the support of 19776 and it held and may pave the way for further upmoves.

Nifty Today Analysis

This was the day today — a perfect flat day. If yesterday’s price action is taken into consideration it shows a good continuity. The pre-open showed more bullishness but except for the gap-up we did not have any bullish momentum today. My long call for today did not yield any results. I do not see a bearish intent — we tried breaking the support of 19776. Even the 19800 psychological level was showing good stability just like yesterday.

On the 1hr TF, I still do not see the reason to abandon my bullish stance. I agree that the 19899 level was not taken out today. But the support of 19776 did not break either. It also makes sense for Nifty to rest after the Tuesday and Wednesday climb. For tomorrow I wish to continue my bullish stance if 19776 support is respected. If that breaks in the morning session, I would like to change my stance to neutral. If 19671 level breaks in the forenoon session — I would definitely go short as we may fall below the double-top formation.

BankNifty Analysis

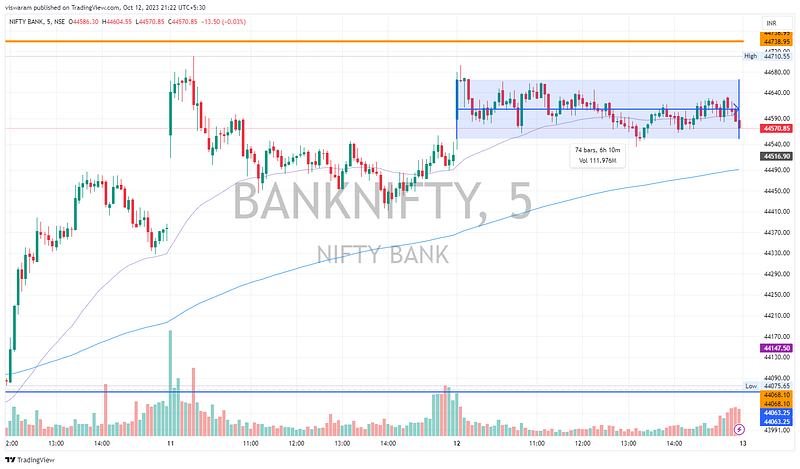

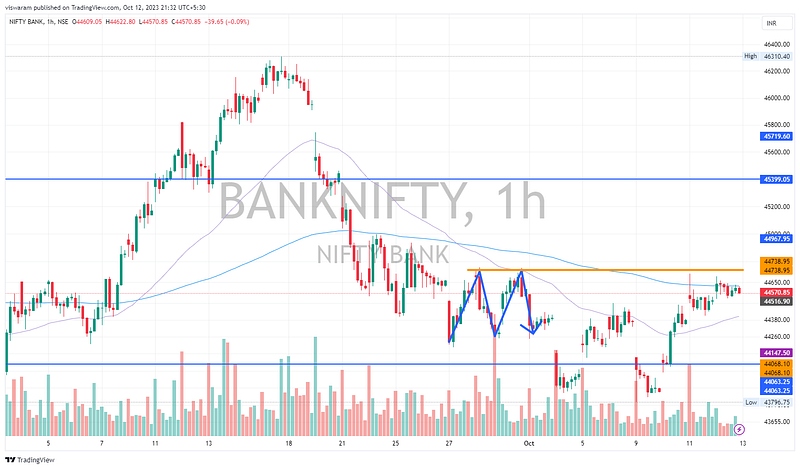

Banknifty also had a perfect flat day today. Since we did not have an attempt to fall, I assume the bulls have a slight advantage over the bears. Its inability to take out the 44738 resistance was also quite worrying.

But there was something strange and heroic by BN today. NiftyIT was falling pretty sharply today on the back of results from TCS. INFY also started falling even though the results came after market hours. NiftyIT fell 1.67% today but had a total swing range of 2% today. The major reason why it was not reflecting on Nifty50 was due to BankNifty’s counter-performance along with RELIANCE & ITC.

Will try to write an article this weekend on why NiftyIT should have Futures & Options enabled and an independent expiry day. The only volatile index out there is IT and since we have a VIX collapse the option sellers are making only peanuts these days (me included). NiftyIT if enabled for FnO will have attractive premiums as it is quite expected to move 1.5 to 2% intraday.

On the 1hr chart, BN shows a sideways pattern. I wish to continue my neutral stance till the resistance of 44738 is taken out. And wish to change to bearish if we break the 44380 levels. After the market closed we got the CPI inflation data and it came at 5.02% — source. This should give a positive boost for tomorrow. Also, the US CPI came at 3.7% — source — but as it stands SPX is trading flat.