4th Oct ’23 — Super recovery in last 90mts — PostMortem on Nifty & BankNifty + HDFCBK spoils the…

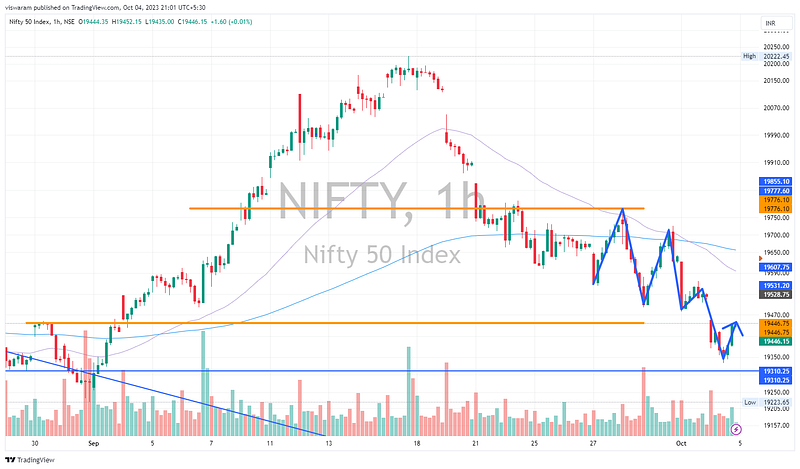

Nifty Analysis

The opening 5mts was quite powerful, quite similar to the one we had yesterday. Interestingly it took out our first support of 19446. We had a followthrough and even hit the low of 19333 but we did not retest nor break the 19310 level.

The main reason for that is the counter move on HDFCBK — which spoiled the party for the bears. Our markets are not alone wherein 2 or 3 stocks can dictate the terms — such is their weightage. Just because of this, the VIX stopped surging and all of a sudden the fallen stocks started getting back on their feet to cover up the lost ground. When news flows — the technical analysis stops working. We will discuss on HDFCBK in the Banknifty expiry section below.

On the 1hr TF, Nifty complied with the double top pattern and showed its vulnerability by breaking the support line. The next support level of 19310 fell short by just 0.1%. If the current momentum holds — then it should be tested and taken out by tomorrow. We also have the expiry tomorrow — which may bring in some added uncertainties.

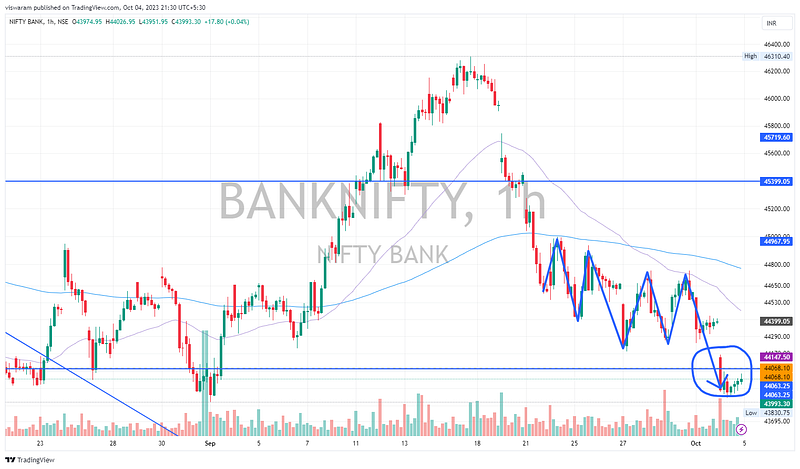

BankNifty Weekly Analysis

Between the last expiry and today, BankNifty has only fallen 291pts. That fall coincides with a strong support level break — which may bring in additional pain for the long-only traders. It is also significant that BankNifty broke the crucial level ahead of Nifty reiterating its position as a leading indicator.

BankNifty Today’s Analysis

I was pretty much disappointed today with the BankNifty’s expiry. Not because I couldnt make any money out of it, but because the premiums were all good for nothing. Even after a 450+ points fall in the opening 10mts — the implied volatility did not move an inch.

Usually OTM premiums spike when BankNifty moves above 1% — but today there was absolutely nothing. 900 points lower strike 43000 PE was trading at Rs2 in the morning session. These are the premiums of strikes we see for 2000 to 2500 pts away from ATM. Most interestingly when BN was at 43880 levels by 12.30, 43500 PE was trading for Rs2.6. There is a solid reason why this happened and I will explain it in detail.

HDFC Bank is the main culprit. It went up 2.53% between open and 10.30. If you look at the daily candle — HDFC shows bearishness. Two strong double tops and then a lower high formation. The true free float weightage is 40.9% — source. Which means a small trigger could change the game.

Ideally, we should have had a strong down day. BankNify ended the day with cuts of 435pts ~ 0.98% — but due to the optimism on HDFCBK, the options premium were pricing in the information that further downside may be limited. The news broke today “HDFC Bank Q2 Update: Advances up 58% YoY, deposits rise 30%”.

On the 1hr TF we have broken the support of 44068, yesterday’s bearish call worked out well despite the misadventure from HDFC. I would like to see if BN can cross this resistance level in the forenoon session. I still maintain the bearish stance with the next target being 43827 and then 43732.