17 Aug ’23 Post Mortem on Nifty & BankNifty + Weekly Expiry Analysis | Bears are still fighting

Nifty Weekly Analysis

We have fallen 201pts ~ 1.03% between the last expiry and today. If you notice the chart below, Nifty is closely following the bearish trend line and we will get a range convergence soon. If the support line of 19309 is not breaking — we will have a bullish reversal. Global macros, India inflation data and other sentiments are pointing for a bearish case though. What will Nifty do?

Nifty Daily Analysis

I was very much impressed with today’s price action by Nifty. If you notice the trades we had yesterday — it was much contrary to what traders were anticipating. Today we just negated those moves.

You might remember the 15.00 candle that went up 45 pts yesterday — it really made no sense. I was thoroughly looking for any events to find out why we had a surge yesterday, but today’s reversal and negation brings back sanity.

We had 2 legs for the fall today, the first leg a fall of 83pts till 10.00 and then the second leg of 89pts between 11.05 to 13.00. The options flow did indicate we would have a bear day today, but I seriously thought the 19309 support line may get broken.

RELIANCE, ITC, HDFCBK, LT, KOTAKBK, BAJFINANCE were the main losers today and TITAN, ADANIENT, SBIN the main winners. The market depth favored the bears too with 33/50 in red.

Finally this is what we have now, the pressure mounting on Nifty50 to breakout or breakdown. Technical Analysis points to a breakout and the Fundamental Analysis hinting at a breakdown due to poor macros. Today’s 99pts fall is giving some hope to the otherwise beaten bears — their first priority tomorrow would be to take out the 19309 support to gather immense downside momentum. I am changing my stance from neutral to 60% bearish & 40% neutral for tomorrow.

If you are enjoying this free content, consider subscribing to my free newsletter — click here

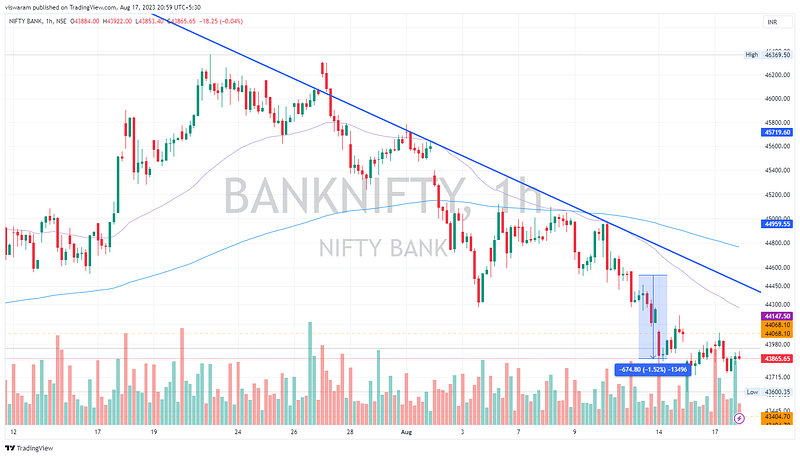

BankNifty Weekly Analysis

The bears have managed to take out 674pts ~ 1.52% between the last expiry and today. A sign of momentum getting built. We have taken out 1 important support level of 44068 in this week — something to cheer for the bears. Overall sentiment is looking bearish as the EMAs are diverging.

BankNifty Today Analysis

We had a flat today, but there was some important action today. Banknifty rallied 231pts ~ 0.53% between 09.35 to 11.05 in a show of character. Guess what point we had the reversal then? 44068 which is the marked SR zone.

The fall from 11.05 lasted till 12.55 with over 321pts ~ 0.73% shed. The good thing for the bulls was that the selling stopped there. We did not retest the swing low of 43600 nor the next support of 43404.

I would say banknifty had so much potential firepower today — visible from the more than usual premiums for OTM. But it did not materialise into actionable swings. Possibly the movements may come tomorrow — let us see how deep the bears can gap us down.

The steepness of the bearish trend line may be at the same angle as that of Nifty, but the action looks more intense for BankNifty. Since the support level of 44068 was not defended and the resistance got rejected — the floor is now open for the BEAR DANCE.

The next support comes 400pts lower and if we manage to take that out with pace — the further drill downs will be easy. On the contrary if we fall slowly, it will open up a congestion zone and the bears may cede control. I wish to maintain the bearish stance for tomorrow as well.

If you have any queries — please drop comments below, I will reply.

3. Free charts made with ❤️ on TradingView

https://viswaram.com/16-aug-23-post-mortem-on-nifty-banknifty-how-many-bears-are-still-alive-d1b0be3247c0https://viswaram.com/16-aug-23-post-mortem-on-nifty-banknifty-how-many-bears-are-still-alive-d1b0be3247c0https://viswaram.com/16-aug-23-post-mortem-on-nifty-banknifty-how-many-bears-are-still-alive-d1b0be3247c0https://viswaram.com/16-aug-23-post-mortem-on-nifty-banknifty-how-many-bears-are-still-alive-d1b0be3247c0