10 Aug ’23 Post Mortem on Nifty & BankNifty + Weekly Expiry Analysis | RBI holds Repo rate @ 6.5%

Nifty Weekly Analysis

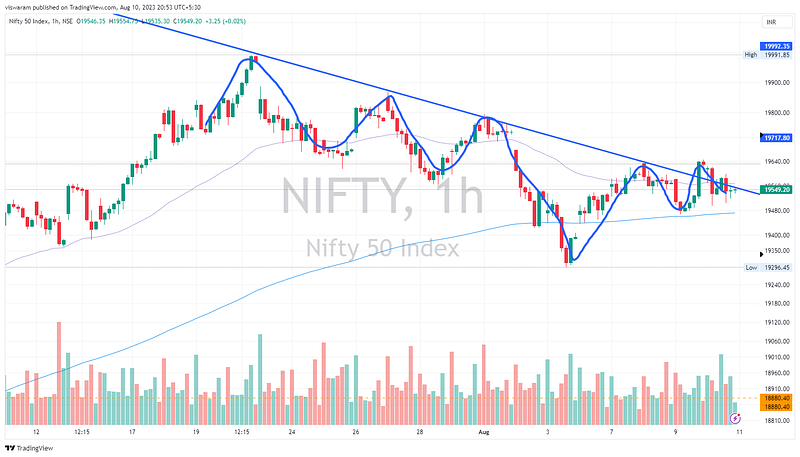

Between the last expiry day and today, Nifty has managed to rise 152pts ~ 0.78% which is a good sign for the bulls. This flattish phase was much required after Nifty picked up a direction from 21st July. The technical analysis points to a trend continuation possibility and should be good for the bears!

Nifty Today Analysis

Today’s move was very much influenced by the RBI MPC decision on Repo rate & Cash reserve ratio. We will discuss that in detail as part of banknifty’s analysis (below). If you recollect yesterday we had an unusual spike in the last 1 hour & most of the traders including me were not expecting that.

What happened today was to negate that move in the opening 1hr. I assume many traders would have taken the stop loss hits both times (1 yesterday and 1 today). After the 1st hour move — nifty did not really go anywhere. If you notice the chart above the price levels at 14.30 yesterday & the close today is the same.

The 100pts in the last 1hr yesterday and the 128pts between 10.20 to 10.40 today was just a roller coaster ride for thrills. The OTM options premiums were reflecting this perfectly — neither did we have a major spike yesterday nor today. So the big boys were quite expecting this.

The 1hr chart shows how nifty has managed to close right at the trend line today. If we have a gap down opening tomorrow — the bears will feel confident to push down the prices further. The first target to take out would be the 19300 levels.

On the other hand if we have a gap-up opening, the bulls will have to take control to breach the 19690 levels which will negate the lower-high formation. My stance is 80% bearish and 20% neutral for tomorrow

BankNifty Weekly Analysis

Between the last expiry and today, banknifty has fallen 34pts ~ 0.08% (flattish). Compare this to Nifty which rose 0.8%. In our markets banks are the leading indicator, whereas in the US its the non-banks. That is why professionals look up to banknifty in India and Nasdaq in the US as leading indicators of trends.

BankNifty Today’s Analysis

We had a gap down opening and traded with no special punch till 10.00. The RBI Governor first announced the status quo on the repo rate of 6.5%. With the prices of food, groceries spiking, I think he made a bold move to keep the interest rate unchanged. This really excited the banks and we started to rally and took out the intraday high of yesterday.

The next 2 announcements tanked the markets, first he revised the inflation forecast for the current year to 5.4% (more pain to the poor). And then he announced a 10% hike in the cash reserve ratio that needs to be maintained by the banks (temporarily). Read the full minutes — click here.

The best way to control inflation is to reduce the liquidity in the markets, a higher CRR will do that — but is it more effective than increasing the repo rate only time will tell. The surprise announcement of withdrawal of Rs2000 notes would have added more liquidity into the system and most of these funds would have found their way into the financial markets (equity or debt). Banks may have to reassess their cash levels to maintain this additional 10% cash with RBI. It will be prudent to hear from HDFCBK, ICICIBK and SBIN on the impact (maybe we can expect a news/event in 1 week).

If you look at the 5mts chart, the fall of 499pts ~ 1.11% stands out. What is more dramatic is the low point went below yesterday’s swing-low unlike Nifty50. And the further price action was negative unlike flattish for Nifty50.

Credits to the bulls who held the ground pretty well even with so much of news/event and historically bubble style valuations. Or it could be because the bigger bears are still hibernating.

Dont be confused with a lot of trend lines. The blue one was there from yesterday, the orange line I drew today, because I felt the blue trend line may be too steep and misleading. What if the gap-up on 27th July was just a blip? If yes, the orange trend line that touches the close of 26th July should be more accurate.

The green highlight shows the double top as well as the H&S pattern in a falling market and respecting the trendlines. I wish to change by stance to 100% bearish for tomorrow.

- Read my latest book “Expiry Day FireFighting Strategies on Nifty50: 4 commonly used option strategies on Nifty50 and expiry day firefighting techniques to limit the max losses + 2 bonus strategies” just for Rs99

- PS: The trades taken are no recommendation, blindly following them may cause more harm than good — read full disclaimer here

- Free charts made with ❤️ on TradingView