04 Aug ’23 Post Mortem on Nifty & BankNifty | Honeymoon over for the bears?

Nifty50 Analysis

For 2 consecutive days the bears had a good time and now it is over! Today’s price action and the inability of the sellers to push down the prices indicate the bulls are gaining traction. Most analysts would prefer to watch for 1 to 2 more days before changing the bearish bias — I would prefer to change my bias from bearish to neutral right away.

In the recent past too, the dips have been very shallow and short lived. Today we had a gap up opening followed by a ZERO attempt to close the gap. The island formation (encircled in blue) shows how high the grapes have been held high for the BEARS (The taste is sour if you were a short seller).

All hope is not lost, not until the trend line is taken out. That is why it is not advised to go long nor go short. I would prefer to trade with a neutral stance till we get more clarity. Every time Nifty hits a new ATH, I think the reversal is overdue and will come shortly. But the fall never came, every time there is a minor correction — the dip buyers come in and rally the markets above the ATHs. Just like me there would be many bears who are eating dust waiting for a crash!

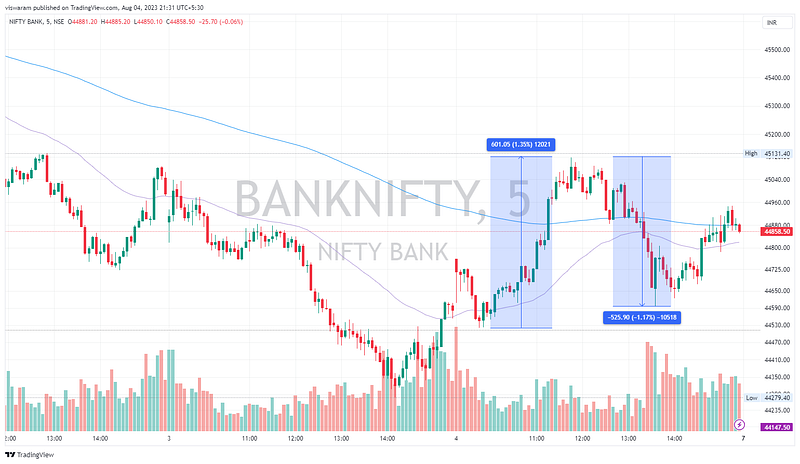

BankNifty Analysis

Banknifty on the other hand is still in the bearish zone and still continues to provide some hope for the handful of bears that are left. Even though we ended up with 0.82% gains compared to 0.7% of Nifty, banks are still not out of bear hold.

The reason is the price action. We had an intraday rally of 601pts ~ 1.35% and then a fall of 525pts ~ 1.17%. Although I changed my stance of Nifty from bearish to neutral, I do not wish to change the stance of banknifty. I prefer to go with bearish bias, but the situations are not conducive for a fall. The crash in India VIX to 10.57% ~ -5.48% is the biggest example.

There is absolutely no fear, the options prices are reflective of that. Since the premiums have dropped, an option seller would be quite scary to take naked positions home. A small rise in volatility will unleash the beast in banknifty — an area to look for is the “Loan growth” reported by the banks and not just their quarterly revenue or profits. Loan growth shows the actual demand. Are people coming in flocks to take new loans? That too with high interest rates?

https://amzn.to/43Rhrqthttps://amzn.to/43Rhrqthttps://amzn.to/43Rhrqt