25 Jul ’23 Post Mortem on Nifty & BankNifty | Nifty Starting to Break Down?

FinNifty Weekly Analysis

Finnifty has actually moved up 209pts ~ 1.03% between the last expiry and today. What this means is the recent reversal in Nifty is yet to reach the financial service index. Moreover the finance sector esp. Banks were looking strong throughout the last week.

FinNifty had a decent expiry today, closing almost flat +0.13%, well it is quite hard to believe when it had almost fallen 0.95% ~ 196pts from the open to 13.35. It was harder to see how it recovered 0.85% ~ 173pts from that in the short interval 13.35 to 14.55. If not for the V shaped recovery we would have had not so exciting weekly gains!

Nifty Analysis

Nifty had a decent recovery between 13.35 to 14.55 where it gained back 89pts ~ 0.46% after it fell 96pts ~ 0.49% from the open. The moves were exactly similar to the financial service index — because it was caused by the FinNifty components. This casts the doubt that it could be an expiry related move rather than a natural pullback.

For better clarity we would need to wait for tomorrow’s trade. Ideally Nifty was poised to continue the falling chat pattern as confirmed by the diverging moving average slope. I almost thought 19600 will get taken out for good today, but that’s exactly the area from which it reversed and gained up all the lost points.

It will be interesting if tomorrow’s trade happens below the 19670 levels which might give the 19707 levels a temporary resistance zone. I still continue to hold the bearish view unless proved wrong by taking out the immediate swing high.

BankNifty Analysis

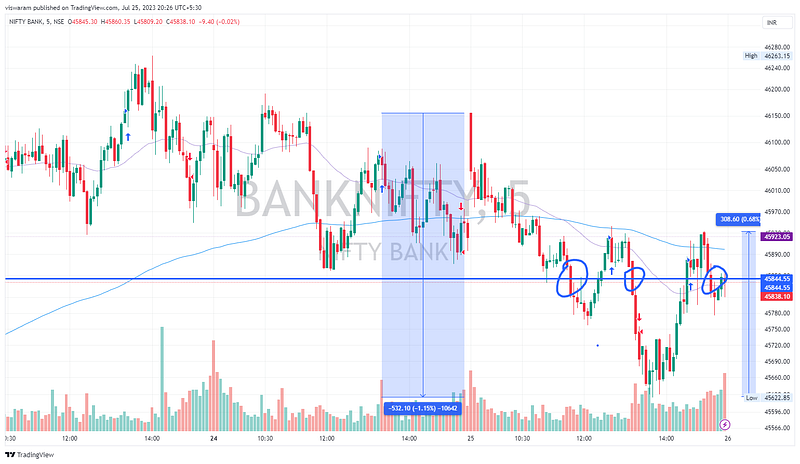

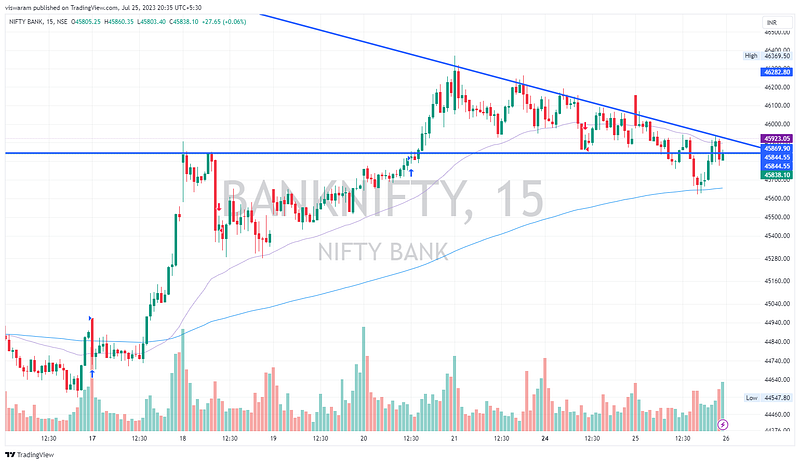

Banknifty’s movement today has given a slight hope for the bears to sharpen their claws. Primarily it breached the 45850–45830 levels thrice today in the 5mts candle. I did mention in the report yesterday that I wish to go short if the 45830 levels are taken out.

The reversal of 308pts from 13.40 to 14.55 would have tested the bear’s conviction level, but the price action if read as a whole is much more encouraging. In fact banknifty fell 1.15% ~ 532pts and the recovery was only 0.68%~ 308pts (A bit less than the 61.8% fibonacci levels). Whereas Nifty50 and FinNifty recovered almost 90%.

Nifty was already in a bearish trend, so the move on banknifty is definitely suggesting further reinforcements towards the south direction. HDFCBK was putting up a rocky vs apollo creed fight today, untiring & unbeatable. This lone wolf was responsible for preventing deep cuts. ICICI Bank was toggling between green and red and finally settled in green. Axis bank had a good recovery in the 13.40 to 14.55 period — but still ended in red. And Kotak was just continuing from the trend yesterday.

I would prefer to go short on banknifty unless the 46000 level is taken out with momentum.