21 Jul ’23 Post Mortem on Nifty & BankNifty | Quite a predictable fall today !

Nifty Analysis

If you had read yesterday’s report, I am sure you would have anticipated the gap down today & the profit taking that followed. Read yesterday’s report — click here. Today’s price action may not be a structural change or the start of the next bear rally (at least too early to comment). What I feel is, we have out run the fundamentals & need to give some time for it to catch up so that the next peak can be conquered.

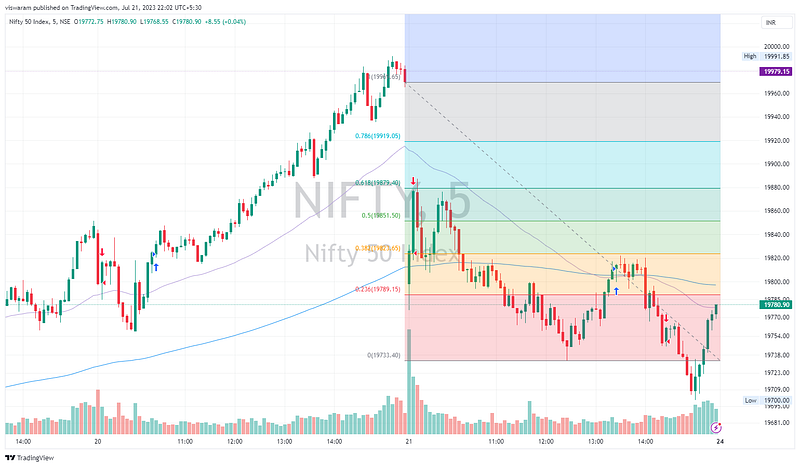

We opened gap down at 19798 and tried to close the distance, but had rejection near the 19880 levels. From there we fell strongly till 12.25 with no signs of retracement or reversal. Once the green candle started forming at 12.30, I drew the fibonacci retracement levels.

I kept yesterday’s close level as 1 and the intraday low formed at 12.25 as 0 — the purpose was to find if we have a continuation in downfall or a reversal to close the gap.

I did share this on nifty minds — see here.

Was this exercise worth it? Absolutely yes.

- We saw the reversal at 09.25 came at 61.8% retracement level

- The lower high formed between 13.30 to 14.00 came at 38.2% retracement level

- The fall that followed and the break of the 0 level creating a new lower low almost gives us a good confidence that the fall in nifty is quite serious.

Trades taken: I did go short as soon as markets opened to catch the moving bus. This was purely a gut decision and nothing to do with positional strategy. At 12.30 as soon as we had the first reversal of the day, I booked the existing short position & rolled down the option to catch more action. This new position was in loss till 14.15 after which we started falling below the low of the day, assessing this situation — I decided to carry forward the position overnight.

Banknifty Analysis

Banknifty on the other hand was staying strong today, although it opened gap down, it closed down the distance in the opening 5mts itself. After hitting a new ATH of 46369.5, it started falling gradually.

Banks were not at all looking weak today. Infosys fell due to poor guidance & Reliance fell after the demerger activity. Financial sector along with pharma and auto was providing support to nifty today.

Between 09.25 to 12.25, banknifty shed 442pts ~ 0.95%, this was the period when nifty hit the initial low of the day. The real divergence came between 12.30 to 13.45 where banknifty retraced 318pts but nifty was unable to recover. A deeper look at the options flow would be useful to find the root cause why banknifty had no plans to fall today.

- CALL credit spreads were not getting written, this usually drives the options premium and gives a clue if banknifty is about to fall.

- The near money PUT premiums were not rising nor the implied volatility.

Banks cannot stay high in isolation, usually when nifty makes large directional movement — the components & sub indices also align their direction in tandem. This is true even if they are in a counter trend independently.

Banknifty is not looking bearish nor any short opportunity is directly visible, we will assess the situation on Monday on how Nifty reacts to RELIANCE, SBI, ICICI numbers.

PS: The trades taken are no recommendation, blindly following them may cause more harm than good — read full disclaimer here