19 Jul ’23 Post Mortem on Nifty & BankNifty | 87pts surge in 45mts!

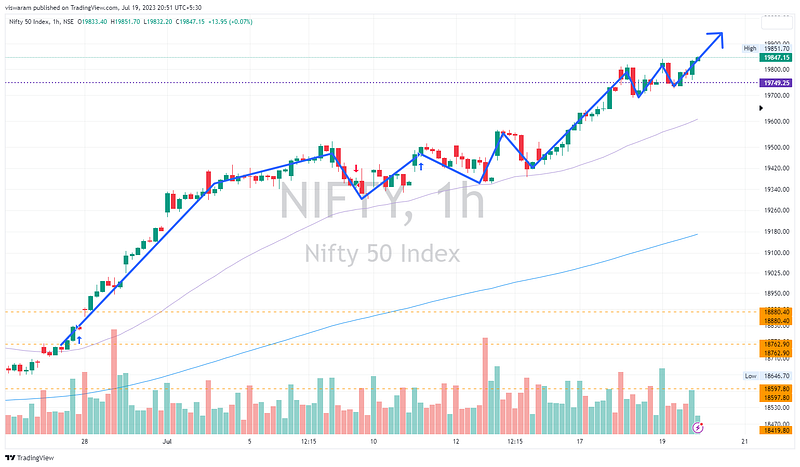

Nifty Analysis

Today turned out to be a non-eventful day for me. Looking at the premiums yesterday, I came prepared to hunt for similar option prices. Unluckily the premiums did not have that wildly swings like yesterday. In the process I ended up not taking what was available 😢

We opened gap up today and then had an up move till 09.55, from there it fell 110 pts ~ 0.56% till 11.15. This fall was quite interesting as most of the candles were red indicating we could have a momentum pick-up later in the day. But by 11.55 the selling pressure was over and nifty climbed back pretty strongly.

One strong reason would be attributed to the reversal in NiftyIT index. It had that perfect V shape today and this sharp reversal helped Nifty scale back up.

Nifty already took out the ATH by 09.55 i.e 19841.65, and what happened in the last 45mts was unbelievable yet again. It formed a new ATH of 19847.15 in the closing minutes showing brute bullish strength.

Ideally Nifty50 should be scaling further heights because there are no visible resistance levels. Similarly few of the bulls could think about profit booking & it could result in a shallow retracement. Usually I prefer to wait out these periods, because as an option seller — I prefer to trade between support & resistance levels. Whereas an option buyer could design a strategy to play the break-out & break-downs.

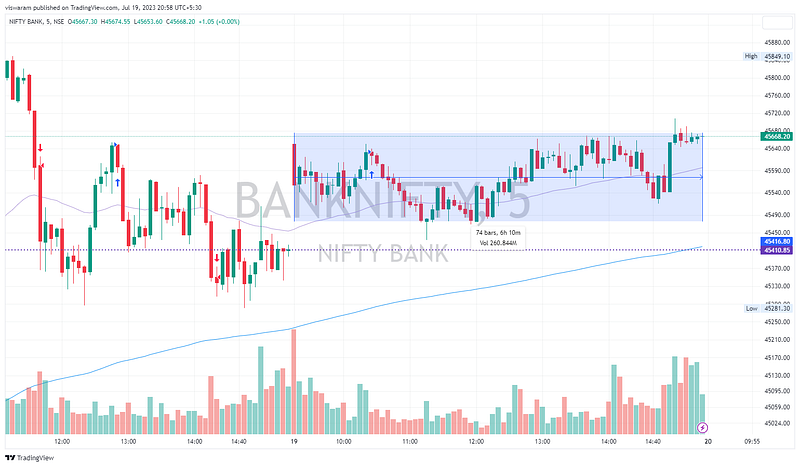

BankNifty Analysis

Banknifty on the other hand had a perfect range bound trade today, the option prices also reflected this & there was absolutely no spike in premiums.

Yesterday we had an action packed price action, whereas it was calm and quiet today. So we have an inside day today meaning the big-boys have taken a day of rest. Most likely we could see a continuation of price action of what we had on 18th July.

But these days Banknify has lost its wild swinging nature, in fact Nifty is showing more tendency to swing. Like mentioned earlier, reasons like this are prompting banknifty traders to switch back to nifty for more bang!

1hr TF should show bullishness, again due to the bearish trend line breakout. The retest of the trend line should happen real quick if bears would like to pass a message, otherwise the field is set for more bull runs.

Again I wish to stay out from trading as we dont have strong support levels.Only if the premiums look enticing, I could go ahead and sell them. Tomorrow’s expiry looks uneventful if the premiums stay like this. Let us hope RELIANCE brings in some drama tomorrow & the banks are called upon to counterbalance the weight on Nifty50.

PS: The trades taken are no recommendation, blindly following them may cause more harm than good — read full disclaimer here