Mutual Funds Investing Strategy 104: Fund your child’s higher education with easy SIPs

Studying abroad in Germany, the UK, the US, Australia, or New Zealand is a familiar thing. Most students dream of pursuing their higher education at a famous international university, but their dreams are cut short when they hear about the required funds.

Due to the devaluation of the rupee against the major developed currencies, the cost of higher education is disproportionately increasing. It is like trying to board a boat that has left the dock, every year you procrastinate — the tougher it gets to meet financially.

You might have reached a stage of life where you wish to send your kids to reputed international universities. You might have missed the boat yourselves, but wish to send your kids for overseas education.

Financial goals like higher education can be completely planned, executed, and realized via mutual fund investments. If you have not read the “goal setting” chapter — please do so now.

https://viswaram.com/mutual-funds-day-1-setting-a-goal-6529fe676c70

Any goal can be converted to its financial equivalent. Calculating the financial equivalent makes it easy to roadmap the plan. Any mutual fund distributor can help you select the instruments required to meet those goals.

For this specific case, we assume you require 40 lakhs when your kid turns 17. We will use the SIP calculator to find the monthly contributions required for the below age groups.

- Start when the kid is 5 years old.

- Start when the kid is 10 years old.

- Start when the kid is 14 years old.

Case 1: The kid is 5 years old.

- Monthly investment required — 7500 rupees

- Annual SIP increment required — 1000 rupees

- Duration 12 years

- Assumed annual returns ~ 13%

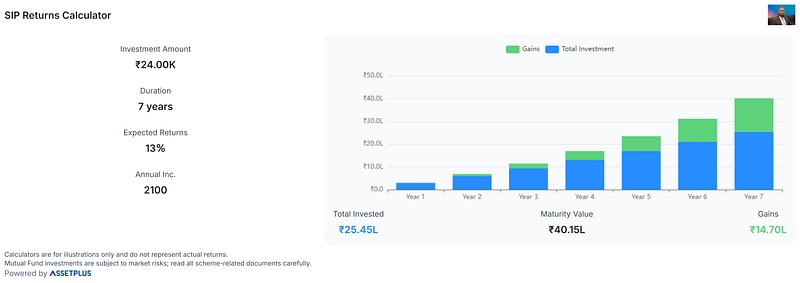

Case 2: The kid is 10 years old.

- Monthly investment required — 24000 rupees

- Annual SIP increment required — 2100 rupees

- Duration 7 years

- Assumed annual returns ~ 13%

Case 3: The kid is 14 years old.

- Monthly investment required — 60000 rupees

- Annual SIP increment required — 9000 rupees

- Duration 3 years

- Assumed annual returns ~ 13%

Notice how the monthly contributions went up when your tenure came down. For a 12-year duration, a monthly contribution of 7500 was sufficient, but when the duration is only 3 years then a monthly contribution of 60000+ is required.

Also note the increment amount that is required, for a 12-year tenure a step-up of 1000 was sufficient, but for a 3-year tenure — you have to increment it by 9000 per year.

Financial goals are much simpler when time is on your side, the magic of compounding works in your favor. The best recommendation would be to start early. Yesterday was the best day to start investing, the 2nd best day is today.

Even if you managed to raise these funds and your kid does not require the corpus, you could utilize it for any other financial goal. Your kid may be very bright that she got a scholarship or maybe he prefers to study in a local university.

It may be really tough to estimate what your kid’s educational discipline will be 12 years from now, but you can forecast your financial discipline much more accurately.

Calculators are for illustrations only and do not represent actual returns.

Mutual Fund investments are subject to market risks; read all scheme-related documents carefully.

If you liked this content, consider sharing it with your friends & relatives..

Book a free consultation — Get your mutual fund holdings audited based on your risk profile — https://learn.viswaram.com/knowmore

Disclaimer: Mutual Fund investments are subject to market risks; read all scheme-related documents carefully.