In Pursuit of Multibaggers — 1st Year Anniversary — 11th Jan

Exactly one year back, I started a small case of 30 stocks. The dream — just one, to spot multibaggers. For the uninitiated, multibaggers are stocks that go up multifold, at least 10 times. So if a stock is priced at 100 now, it should be priced at 1000 within a period. A conservative investor would want the 10x growth to be within 10 years, whereas an aggressive investor may want it in 5. I guess I am somewhere in between.

If you ask me, if I have any experience in spotting multibaggers — I would say YES!. Check this post by me in 2012. You can do the math yourself.

https://banknifty.viswaram.com/2012/01/top-midcap-and-smallcap-picks-for-2015.html

I started trading in 2010 and the above post was when I had 2 years of wisdom. Obviously, people expect your experience, exposure and knowledge to go up when you spend more hours on what you are passionate about.

Due to regulatory challenges, I am unable to post the list of stocks here (Yep, I would like to become a SEBI research analyst soon), but I can share the steps and journey I endured which can benefit you in multiple ways.

Firstly, the list of 30 stocks I have identified were between 800 to 4000 crore market cap. This ensures that these upcoming companies have a strong legroom to flex their muscle.

Secondly, I went for firms that were having positive growth in sales. I did not want to add on to firms that were losing money, even though they were capable of turnaround.

Thirdly, I wanted to ensure that the P/E was not over-inflated and then the PEG ratio was positive but less than 5.

Finally, I wanted to filter out the firms that had a decent operating margin. Something close to 5% was a strong no-no and something close to 50% was weeded out either. 15 to 40% was an acceptable level for me.

If you run the following query on screener, you might end up with approximately 200 companies. How do you select 30 from it?

The final selection of 30 companies was the toughest part, it took almost 6 months of watching before I could finalize something. Even then my research was still a work in progress and I decided to start with whatever I could narrow down by 11th Jan 2024. I cannot really comment on how those 30 were selected, but I can say it was a mix of fundamentals as well as chart patterns (technicals).

Once the firms were added, my job was to do the quarterly rebalancing. The 3 to 5 firms that were the laggards had the highest possibility of being thrown out. It was replaced by something from the same screener. I also ensured that the firms that got removed would not be added back at least for 3 quarters even if they made a U-turn.

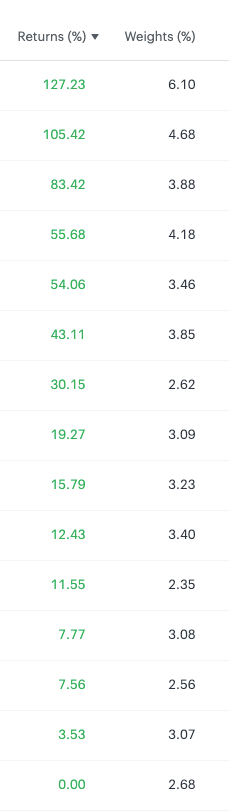

The results are as follows.

Final returns = 6.42%

XIRR = 14.38%

Dividends = 979.7, Dividend yield = 0.224%

Realized returns = -6770, -1.55% drag.

The final performance had much to do with the current rout in markets. You know pretty well that Nifty has fallen ~ 11% from the top. I guess my best performance was in July-Aug when the fund showed a return of close to 38%.

Final inference.

I have managed to find 2 companies that have gone up 100% or more. 3 firms with 75% or more, 5 firms with 50%+ returns, and 7 firms with 25% returns.

Similarly, the laggards are — 1 firms with a loss of 25%, 3 firms with a loss of 20% or more, 5 firms with 15% or more losses, and 9 firms with a loss of 10% or more.

Interestingly, the losses on equity are limited and the gains are unlimited. The beauty of doing something like this via smallcases is that the weightage will go up for the winners and the laggards will starve.

I have managed to contribute to these funds as SIP every week and would like to step up the contribution in 2025. I hope to target 30% or more yearly returns for these funds and expect the investing gods to be with me.

https://banknifty.viswaram.com/2012/01/top-midcap-and-smallcap-picks-for-2015.html