Mutual Funds Awareness 101: What is a Quality 30 Smart Beta product?

NSE defines the Nifty100 Quality 30 as an index that “aims to cover companies which have a durable business model resulting in sustained growth.” This means NSE will shortlist 30 companies out of the top 100 that meet the quality requirements.

“This index consists of 30 companies which are selected based on low gearing, high return on equity and profit growth. Stocks are selected based on quality score which is calculated on the basis of Return on equity (ROE), Debt equity ratio (D/E) and Average change in EPS.” — source.

Firstly, we need to understand the need for a quality index when we already have nifty 50, nifty 100, nifty 500 indices. All the above indices are free-float market cap weighted. This means a big stock like HDFC Bank or ICICI Bank has a huge weightage and when the investor pumps in money, these stocks grow bigger, which will in turn increase their weightage. So, its like a spiral that feeds itself and grows bigger.

- If you look at Nifty50, HDFC+ICICI accounts for 22.32% weightage, i.e. 2 stocks will eat Rs22.32 out of every Rs100 you are investing in a 50 stock basket — source.

- In Nifty100, HDFC+ICICI accounts for 18.47% weightage, i.e. 2 stocks will eat away Rs18.47 out of every Rs100 you are investing in a 100 stock basket — source.

- In Nifty500, HDFC+ICICI accounts for 13.21% weightage, i.e. 2 stocks will eat away Rs13.21 out of every Rs100 you are investing in a 500 stock basket — source.

I am not saying HDFC+ICICI are not good stocks, but when we go with a market cap weighted scheme, the amounts that get allocated to these giants are so huge that investments in smaller companies are overshadowed. Imagine there is a company that has the potential to grow 10x, but has only 0.5% weightage on the index? It means out of Rs100 you are investing, only 50 paisa goes to this firm, and if that grows 10x, you get Rs5, which is only 5% of the invested capital.

The solution is a smart beta fund, something like a quality index that is tilt-weighted. The image below shows the Nifty100 Quality 30 index. Notice the weightage methodology is Tilt instead of free-float Mcap. Also HDFC has a weightage of 5.44% and ICICI is not there in the Top 10.

The other 9 stocks in the top 10 have a decent weightage spread, i.e., between 4.16% to 5.59%. This means the amount you are investing will get a more uniform spread than a Nifty100 index fund.

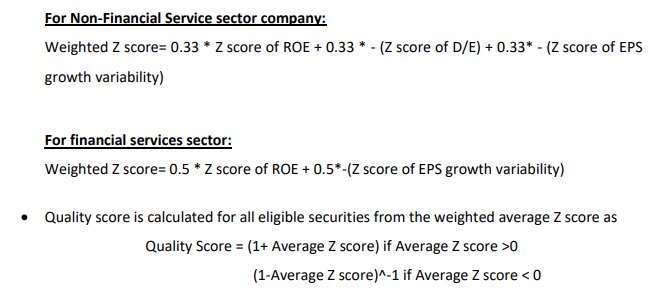

Okay, we talked about the weightage part, now let us talk about the quality part. NSE has defined a variable “z” that calculates the quality of a stock. It is based on return on equity (ROE), debt-to-equity (D/E) ratio and EPS growth variability in the previous 5 years. D/E is not considered for financial stocks.

z = (x — μ)/ σ

where

x is parameter value of the stock.

µ is mean value of the parameter in the eligible universe.

σ is std. deviation of parameter in the eligible universe.

The companies are listed in descending order of the final quality score, and the top 30 companies are represented in the Quality Index. The rebalancing, reindexing and components management is done by the NSE team and all a mutual fund has to do is mirror that. Hence, these mutual fund schemes are passive in nature.

To find the mutual funds and ETFs under this scheme, login to your investor app, click on store and just search for quality under the mutual funds section. If you are yet to sign up with me, click https://www.wealthy.in/p/viswaram to create a free account today.

If you liked this article, consider sharing it with someone who could benefit from this.

Read my latest book — How to join the top 1% options traders club from Amazon