Mutual Funds Investing Strategy 103: Risk Management & Fund Selection

Everyone talks about risk but has yet to learn what it really means. Risk can be an actual loss or a perception that you could lose. Usually, the feeling that you could lose in the future is much more powerful than the actual loss.

Fear drives us crazy and makes us do irrational things. If you look back the stupidest financial decisions we would have taken would be out of fear or fear of missing out.

When it comes to investing, having a rational frame of mind is critical. Risk has an inverse relation with time. The higher your timeframe, the chances of the risk occurring is lower. If the time duration is lower, then the risk has a higher significance.

We will quickly analyze why risk has an inverse relation with time.

If you are investing in a company called “ABC Bank”. You have done the due diligence, read the fundamentals and you feel the company is fairly valued and a good bet. You decide to invest 100000 for 6 months.

After 4 months, you are up 10% as the ABC Bank is doing quite well, but after the 5th month, the central bank comes up with a report saying that ABC is noncompliant with its digital customer acquisition software. Over the next few days the stock tanks 25%.

ABC Bank provides clarification and updates that it will get it sorted out in 6 to 9 months and the stock recovers a bit. After the 6th month when you wish to redeem, the stock is still 15% down. This is what will happen if your period is too short.

Suppose your period is say 5 years, then most of the short-term risks will fade out. Let us go by the above example itself, most likely the ABC Bank will find a solution in 6 to 9 months and the central bank will accept that. The stocks may end up rising 25 to 30% after this news event.

When you wanted the money, the portfolio was not performing and you had to withdraw the capital at a loss. But after a while, the portfolio would have gone up 10 to 15%.

Mutual funds automatically handle these risks as they invest in many companies at the same time, so the impact a particular company has on the overall portfolio will be limited. Still, there would be many risks the fund manager goes through, I am quite sure their risk management team would be much better than our individual skills.

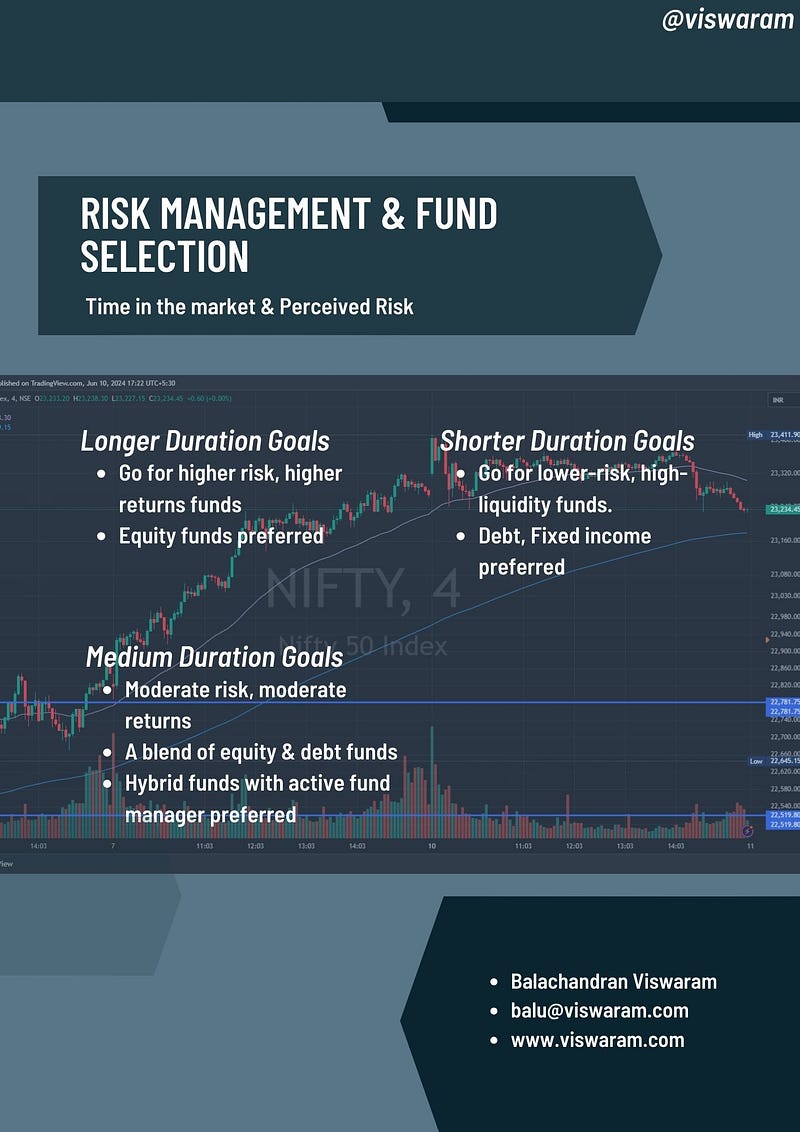

If your investment duration is very short, go for a fixed income instrument as it does not have equity exposure. Most likely the volatility will be lower and the fluctuations of the NAVs will be lesser. These funds could be highly liquid so that you can redeem the investment on short notice and without any exit loads.

If your investment duration is short to medium term, go for a hybrid fund that has both equity and debt exposure. We are combining the positives of both equity and debt to get a better returns profile at a slightly reduced risk profile. Hybrid funds usually have an exit load for the first year.

If you have a longer term horizon, then there are no asset classes that give the returns of equity. An active fund manager ensures that even if one of the companies goes bad, they will replace it with a better firm soon thereby exposing your capital to the best firms in the country.

All investments come with risks, even mutual funds have risks. The above rule may or may not play in actual scenarios depending on the market conditions, economic scenario, political risks, global sanctions, or even a military war.

If you liked this content, consider sharing it with your friends & relatives..

Book a free consultation — Get your mutual fund holdings audited based on your risk profile — https://learn.viswaram.com/knowmore

Disclaimer: Mutual Fund investments are subject to market risks; read all scheme-related documents carefully.