Impact of taxation on Mutual Funds and Stocks

We had a golden period from 2004 to 2018 wherein the capital gains were exempted from taxes. Arun Jaitley – Finance Minister(then), re-introduced long-term capital gains (LTCG) in 2018 to squeeze out additional revenues for the central government. LTCG was 10% then and is currently 12.5%.

Capital markets react inversly to taxes all the time. Noticeably, our markets rallied when taxes were withdrawn in 2004 (UPA Govt) and fell when taxes were re-introduced in 2018 (NDA Govt).

Markets have an inherent tendency to go up mostly due to inflation. In rupee terms, our markets have done well since 2018. The moment you compare it with the US markets, you can really find the answer as to why FIIs are selling off their assets here in India.

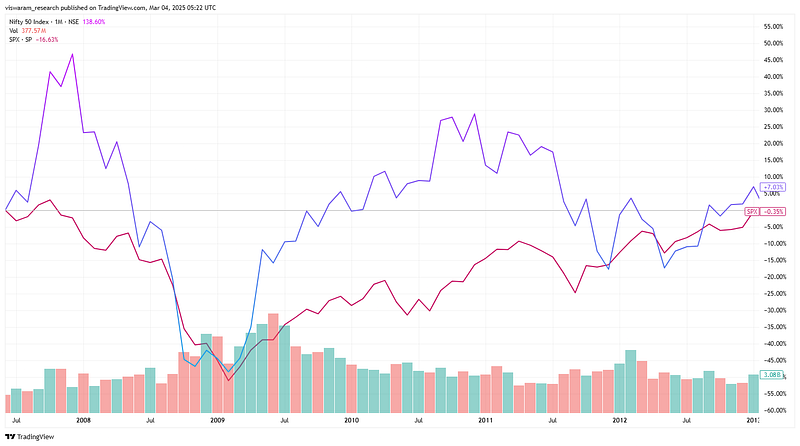

As per the chart, see the performance from 1st Jan 2018 to 04 Mar 2025.

- India markets are up 46% in dollar terms.

- The US markets are up a whopping 107%.

The obvious question is, why would the FIIs actually want to invest in India if our performance is below theirs? Any rational investor would want to make as much money as possible. Sentiments or relation is hardly a data point to invest in India, especially when the home markets are performing well.

The same holds for currencies lower than ours. Indian investors would want to explore investments in Uganda if their capital markets are returning more than ours, adjusted for currency fluctuations. If their capital markets are underperforming, Indians can invest in home markets and do away with currency volatility.

Things were not like this before; our nation had the best minds at the top, and we as a country made a real impact on how risk capital is utilized.

For the period 2004 to 2012, even with the great financial crisis (2008) in between, Indian markets outperformed the US markets.

- India’s Nifty up 7.03% dollar adjusted.

- US SPX flat at -0.35% dollar adjusted.

If our markets had outperformed the US markets by at least 50% from 2018 to present, a tax burden of 2% may not have created a ruckus. When we are underperforming, a tax is usually the final nail in the coffin.

This divergence started appearing when Trump assumed the presidency and the global macros started changing — eg. imposition of tariffs, import restrictions, sale of military equipment etc. All of a sudden, businesses in the US got an edge vs global peers, and their stock markets & currency started going up, widening the gap with emerging markets. The India:US underperformance was only 20% in Sep 2024 vs 60% now. A mind-boggling 40% divergence happened in the last 5 months.

https://x.com/viswaram/status/1896801164446109715

Samir Arora explained it beautifully in the above X video. He also mentioned the Govt. should make course corrections if they realize they made a poor decision.

I have a contrarian view: if the Govt. slashes the tax rates, our markets will sell-off much faster. FIIs would find it more comfortable to exit their positions and move to their home market. And a sell-off would further drop the rupee and create a downward spiralling effect.

From a long-term perspective, doing away with the capital gains tax is really good for Indian investors. More and more local investors would want to shift from tangible assets to mutual funds. So, even if the markets sell off in the short term, it would create value for the longer term. Indians are dying to step away from real estate investment (heavily overvalued) to mutual funds, and a tax break could really tip the scale.

As per Nirmala Sitharaman’s statement, “Do we really need FIIs?, Retail traders are the shock absorbers.”, In a way, she is correct. When the retail investor percentage goes up from the current 5 to 7% to 18 to 20%, we could reach a critical mass moment. That is when the retail traders would have contributed a better share of “risk capital” than the foreigners.

If you liked this article, consider forwarding it to your friend/relative who would benefit from reading it…