Index Funds are the biggest trickery that everyone is okay with

Let us first understand what an index fund is and then we will discuss how knowingly or unknowingly we let it trick us. Most of us might be familiar with mutual funds. We pay some amount to a fund manager and he invests that in a basket of stocks. The ratio in which that fund manager allocates the money to the respective stocks entirely depends on the purpose of that mutual fund.

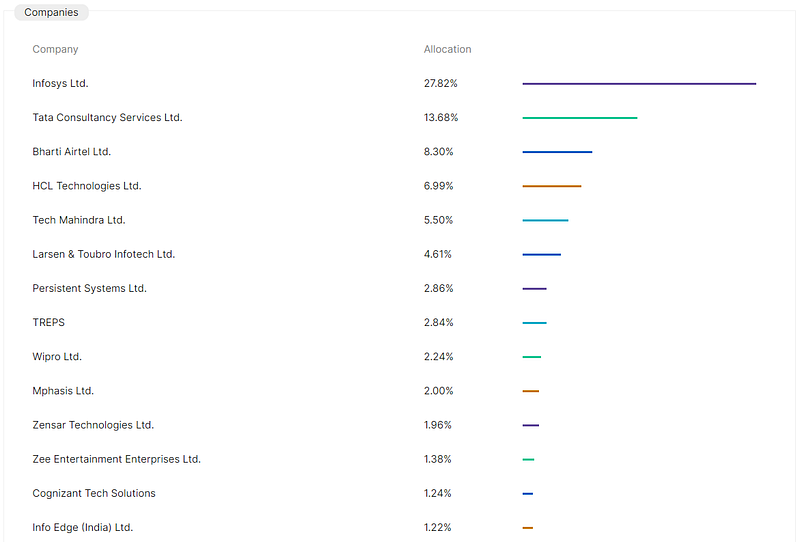

For example, we could have a “Technology Fund” source that invests 27.82% of your contribution to Infosys, 13.68% to TCS, 8.3% to Airtel. If you paid Rs10000 to this mutual fund — they will buy Rs2782 worth of shares of Infy, Rs1368 of TCS and Rs830 of Airtel. Similarly, they will allocate the entire Rs10000 to these listed companies in the mentioned weightage.

These mutual funds are called active mutual funds — because a fund manager actively buys/sells the company’s shares based on its results, valuation, guidance and other fundamental/technical reasons.

Why do we really require a fund manager? Can we not buy or sell these shares and make more money, why do we have to pay someone to do that for us? The answer lies in competency. At an individual level, one would not have enough time, resources, or access to find these good companies and time the entries and exits. A Fund Manager on the other hand has access to almost all the management decisions and has a core team working under his belt — evaluating every single move taken by these component companies. And to an extent has good trading knowledge to hedge the bets and save money.

The people who invest in mutual funds are normally salaried employees or professionals who are doing unrelated work with respect to finance. They entrust someone else to do the asset allocation on their behalf. I am a huge fan of these actively managed mutual funds — because it has given opportunity for common people to invest in stock markets indirectly.

The next category of mutual funds is INDEX FUNDS. These are mutual funds that do not have an active fund management team — instead, they do a rebalancing activity once a quarter or half-year as mentioned in their scheme document. For the same reason, it is called a passive mutual fund.

Now what is an index? The index is a basket of hand-picked stocks that serve some purpose. For example, we have the Nifty50 index which is a collection of 50 top companies in India source

The weightage chart of Nifty50 — source

Few things to understand here. Even though there are 50 companies in Nifty50 — not all of them have the same weightage. The weightage is directly proportional to the free-float market cap of the company. If you do not understand what market cap is — what it means is the bigger the company, the higher its weightage on Nifty50.

In the example above HDFCBK has a weightage of 13.3%, Reliance of 9.21%, ICICI of 7.74% etc. These 10 companies have a cumulative weightage of 58.22% whereas the remaining 20 companies have a weightage of 41.78%. If you allocate Rs1000 to a Nifty50 index fund the amount that gets invested in each of these firms will be.

There is nothing wrong so far — nothing illegal or scam. But imagine what will happen if everyone starts investing in index funds. Out of every Rs100 brought into the fund, Rs13 will go into buying HDFCBK and Rs9 to RELIANCE.

Stocks usually go up in price if the buyer’s demand is higher. So if 13 out of 100 is chasing HDFCBK then there is a high propensity for the stock price of HDFC to go up. This is a never-ending spiral because once the HDFCBK stock goes up, its market cap will also rise and thereby its weightage on the index. Passive mutual funds automatically allocate money to the stock that has higher weightage compared to active mutual funds which allocate to the deserving company.

When the going is good — it does not really matter if you have an active fund or passive fund, because the returns will be comparable due to the high expense ratio of the active fund. But when the times are bad or we have an extended bear market — the passive funds will really test our cool. Luckily India has not had a strong bear market or extended years of low market returns. So it is not obvious now.

Secondly when there is selling pressure due to any external influence — the stocks with the highest weightage get impacted most. For every Rs10000 redemption, Rs1330 has to come out from HDFCBK as it is invested in that proportion. So for extended periods of selling, the biggest firms will face the axe first. This again goes into another spiraling effect — the stock with the highest weightage gets sold the most. The selling further reduces the price of the stock thereby reducing its Mcap. When the Mcap reduces and the weightage goes down, the mutual fund is further forced to sell off its holdings.

If you look at our stock markets — it seems to be an upward-sloping line. Something that has given constant returns to date. We did have 50% corrections a few times and almost a 40% correction during the Covid lockdown. As long as this constant returns to scale is continuing there are no challenges with index funds or SIPs — it will continue to give you positive returns.

But when there are stages of negative growth or no-growth then it could even be a wealth destroyer. S&P500 took 9131 days to reach the same level it had hit in Oct 1929 — a wait of 25 years. People who had invested from 1922 to 1929 would have gone broke or retired with less money than they saved. Economic cycles of boom and bust are natural and must be respected. Currently, the central bankers are trying to manufacture a boom-only period and then they artificially stimulate the economy to have a reduced recession or bust period.