India’s Financial Sector is changing, and it is for the good.

I recently attended the 26th Budget Conclave conducted by Malayala Manorama and the guest speaker was Dr. Rajiv Kumar. In his speech, he shared 2 slides

- India’s Banking Sector

- Growth in Demat account

In the first slide, India’s credit-to-deposit ratio is shown as increasing. Let us break it down to understand what it means.

Credit growth is the rise in the number of loans being issued by commercial banks. Deposit growth on the other hand means the fresh deposits made (fixed deposits or time deposits) by the investors in the bank.

Credit growth shows the outflow of funds and deposit growth shows an inflow of funds. Even after accounting for fractional reserve banking, a commercial bank needs to have strong growth in deposit rates so that it can continue to provide incremental loans to its customers.

A higher credit-deposit ratio could really mean our deposits (denominator) are falling much faster than the credit (numerator) rising. The speaker was quite worried about this phenomenon and I am here to reassure you that it is really good for the economy.

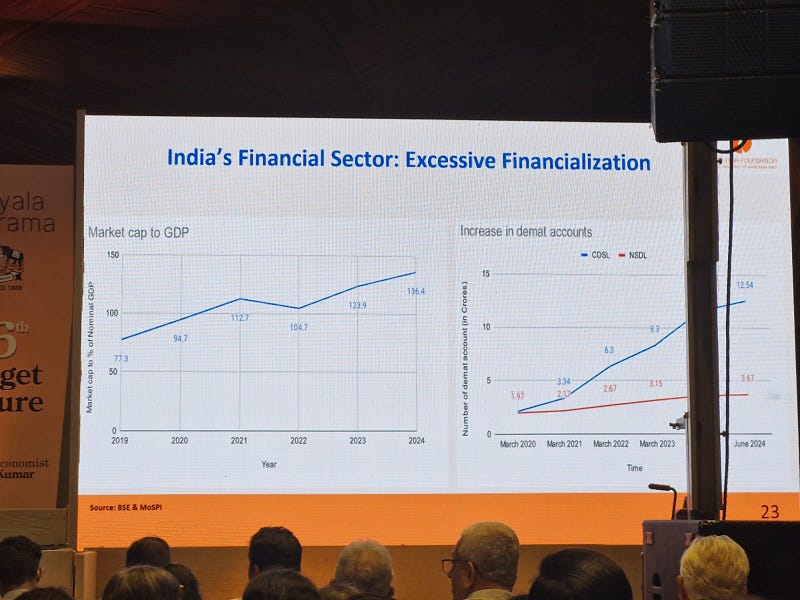

The second slide shows the growth in investor accounts. More demats are getting opened and more people are investing in mutual funds. Our market cap to GDP is increasing and has taken an entirely new trajectory post the Covid lockdown.

During bull runs, capital markets usually suck in investors. Most of them will redeem their FDs and buy mutual funds or stocks. This is nothing new, the inverse is also true, during bear runs people will sell off their portfolios and go back to fixed deposits.

A higher percentage of the population shifting from conventional deposits to mutual funds will weaken the banking system. Their loan book will have fewer deposits as collateral and this could seriously limit their new credit growth. RBI will definitely intervene if the banks are maintaining the over-leveraged path.

I am here to tell you that there is an alternate path, a way by which the banks are happy and at the same time the investors are happy. It is by pledging of mutual funds and shares.

Let investors buy more MFs and stocks. An increase in risk capital is good for the country. More and more enterprises will be ready to open shop if risk capital is available. Innovative and disruptive products will be manufactured and serviced. In fact, this is the main reason the US is so developed.

Give the green light to the banks to accept shares and mutual funds as collateral and issue credits (loans). The banks can continue to grow their loan book without too much dependency on the deposits. It is like monetizing assets that you had no idea that existed.

For example, If I have a mutual fund holding 1 crore rupees and I wish to take a housing loan for 70 lakhs, then it should be easily possible by accepting my share certificates as collateral.

Two good things happen here

- These shares that I hold are proper assets. Instead of selling them, I can monetize them and save on taxes.

- Money in the capital market usually does not come to the debt market. With this linkage, the banks can generate better efficiency and improve their profits.

Point number 2 is bound to create a lot of confusion. Equity markets and Debt markets are distinct entities. Money in the savings account is not the same as money in the demat account. The money supply M3 does not take into account the equity shares/mutual funds that you are holding. So what the commercial banks are holding, and transacting is in no way related to equity shares that change hands from person to person.

The only way to bring about a linkage is by accepting shares as collateral and then issuing loans. As the market-cap to GDP ratio keeps increasing, more and more assets could be pledged and credit issued. This will strengthen the commercial banks in a better way.

Collateral pledges are not something new, ever since the invention of capital markets, it has been there, but they are not that popular. Ordinary people like you and me would not have heard about it, but the rich people were already using it. You might have heard about the “Promoter Pledge”, wherein the owner of the company is taking loans against his equity shares.

If the companies I had invested in continue to grow, then the portfolio value will go up in the future. This appreciation of assets would not have been possible if I had sold them.

The opposite is also true, if the companies I have invested fall in value — then a major setback could occur. The banks will call you and say the margin you have provided will not cover the loan value, this is called a margin call. So the emphasis is on finding good companies and good mutual funds that show resilience with respect to market volatility.

Hope you liked the article, do consider sharing this with your friends and relatives if you think it might benefit them.