Insurance Strategies 101: Term Insurance or Endowment Plans & ULIPs?

Nobody likes to buy an insurance plan, the concept of paying money to get nothing in return haunts us. The dislike for term insurance is real, I have personally seen clients asking for an endowment policy instead of term insurance.

For starters, term insurance is when you pay a premium for life coverage, in the advent of death your family is compensated with the sum assured. In case you survive, you will lose the premium paid.

An Endowment policy is where a portion of the premium goes into investments and the rest to cover your life. Somehow people think endowment plans are better than term insurance plans.

It is not.

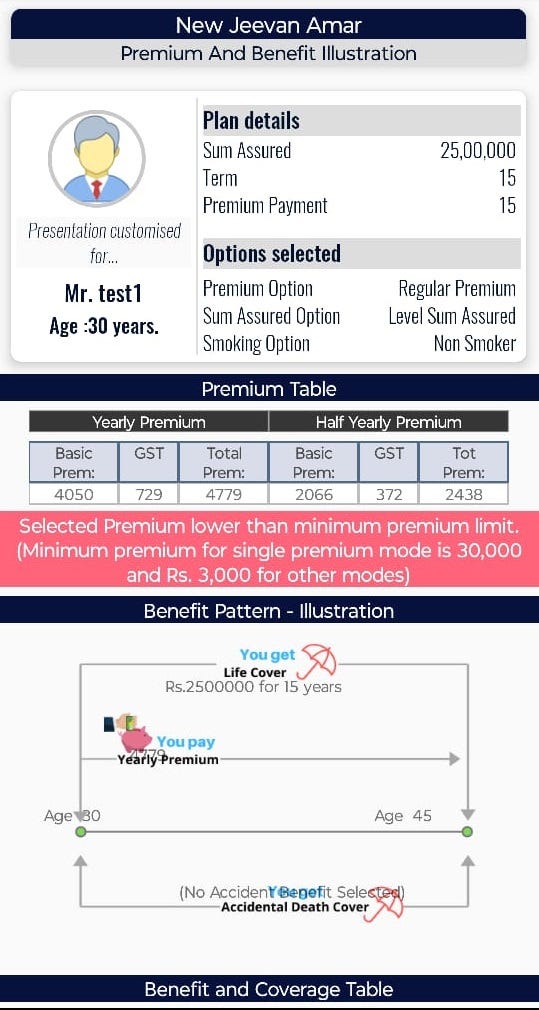

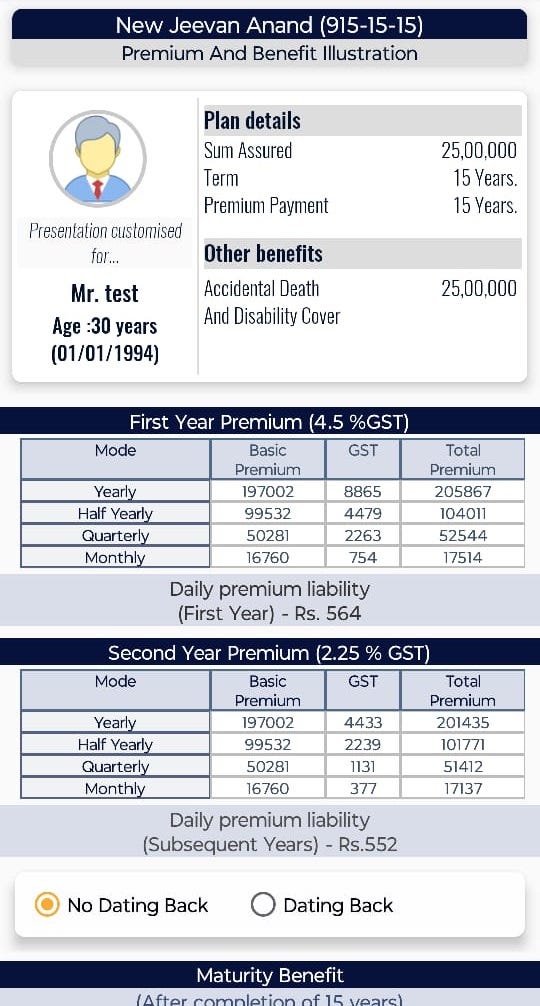

Shown below are 2 popular plans for 30 year old male, non-smoker for 25,00,000 sum assured for 15 years.

- Term insurance, Jeevan Amar — Rs4779 premium.

- Endowment plan, new Jeevan Anand — Rs2,05,867 premium.

In term insurance, you do not get anything back when you survive, but in an endowment plan — you get survival benefits. Take a look at the premiums, for getting the same coverage of 25,00,000 you need to pay a huge premium for endowment benefits.

I am not against endowment, moneyback, or whole life insurance plans — they are required and a lot of customers feel safer buying them, I respect that. But what if I told you, you could invest 201435–4779 = 196656 in an equity or hybrid mutual fund for the same 15 year tenure?

ULIPs — Unit Linked Insurance Policies are yet another classification of bundled insurance products. It was a major weapon in the arsenal for Banks, Investment advisors etc in the 2010s — but now it is not. People started realizing that if they split the total money into insurance and investments, they would get a better yield than going with ULIPs. In ULIPs the end customer is unable to make out how much actually gets invested and how much goes to insurance — meaning the transparency is missing.

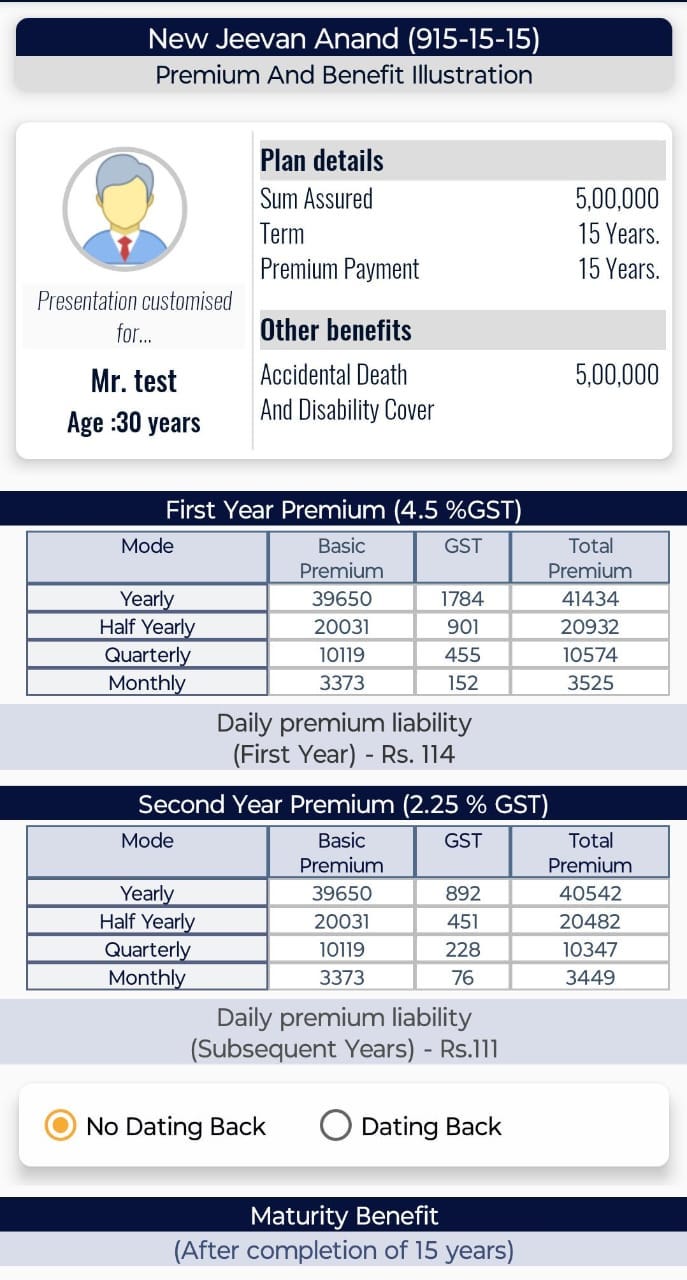

Do you know how the story ends? The customer will end up buying an endowment plan for a sum assured of 5,00,000. This will bring down the total premiums to 41434 per year, but they are not realizing that the life coverage has taken a huge hit. Their sum assured is now only 1/5th of the original plan.

The advisor by default capitalizes on every opportunity to sell a higher premium ticket, and cannot blame them as they work on commissions. I am an advisor myself, so I can relate.

But my real question is if the advisor educates the client that going ahead with a term plan is a better package even though he gets a lower commission — will he be ready to do that? I don’t think so.

I recommend that you earmark some amount for insurance every year. You should be ready to shell out that premium and expect nothing in return. In fact you should be glad that you survived the period rather than thinking you threw away money. Insurance works best when you are not there to tell the story, your family’s needs will be taken care of in your absence.

And how much should be your life coverage? The answer is simple, divide your annual income with the SBI’s 10 year deposit rate.

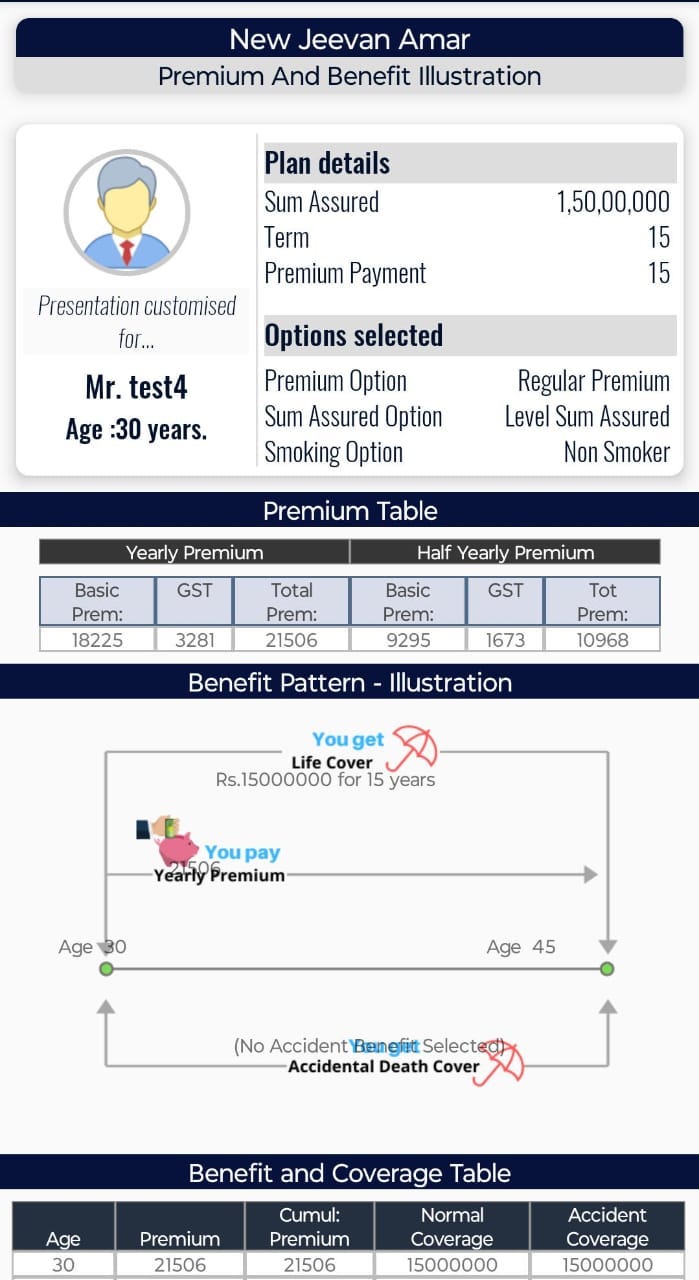

The table says 6.5%, so if your annual income is 10,00,000 then your sum assured (insurance coverage) should be 1000000/6.5% = 1,53,84,615.38 ~ 1.5 crores.

The rationale is — if you pass away, your family gets 1.5 crore as a death benefit and they visit a nearby SBI bank and deposit this amount. This ensures that your annual income is compensated. Note that your physical presence and value can never be replaced, but your annual income can.

It will cost you approx Rs21506 per year to get a life coverage of 1.5 crore.

Disclaimer: Insurance is a subject matter of solicitation, a third-party premium calculator tool was used for data representation. Consult your insurance advisor to get accurate quotes.

If you liked this content, consider sharing it with your friends & relatives..

Book a free consultation — Get your mutual fund holdings audited based on your risk profile — https://learn.viswaram.com/knowmore

Disclaimer: Mutual Fund investments are subject to market risks; read all scheme-related documents carefully.