Mutual Funds Day 18: Market Capitalization & Free Float

Market Capitalization ie. Mcap means the share price multiplied by the number of shares. if XYZ company issues 10000 shares and each has a price of 15, then the mcap = 10000*15 = 1,50,000.

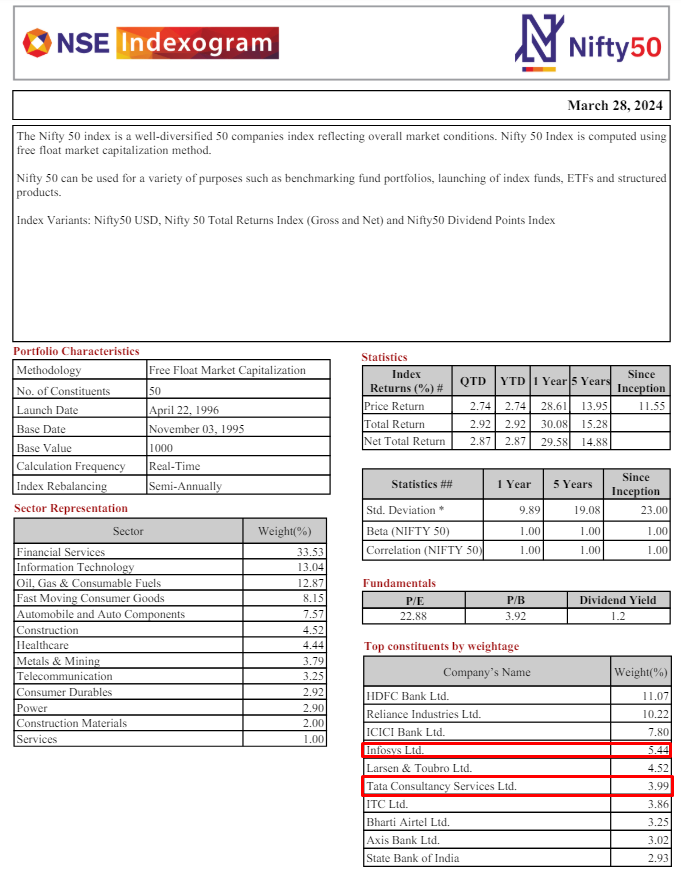

In the above eg: TCS MCap is 1377858.27 crores and Infosys is 581349.77 crores. Mcap shows how big a company is, from the above example, TCS is almost 2.37 times bigger than Infosys.

All the companies are listed in descending order of their Mcap. The largest company is listed first and the smallest company is listed last. This listing helps Mutual Funds select suitable firms to meet their investment objective and goals. SEBI has also brought in regulations and classifications based on the Mcap (we will learn in a separate chapter).

Free Float market cap — means how much quantity of shares are actually available for trading. There could be instances when the promoters prefer to keep shares in the untraded category.

In the above example. if the owners of XYZ say they permit only 5000 shares to be traded then the free float Mcap = 5000*15 = 75000.

All major Indian indices are based on free-float Mcap. Infosys has a higher weight in the Nifty index than TCS even though its Mcap is less than half. Infosys has a 5.44% weight on Nifty50 versus TCS — 3.99%. More shares of Infosys are tradeable, hence the higher free-float.

https://viswaram.com/mutual-funds-day-19-multicap-fund-3c820cdd5524

If you liked this content, consider sharing it with your friends & relatives..

Book a free consultation — Get your mutual fund holdings audited based on your risk profile — https://learn.viswaram.com/knowmore