Mutual Funds Day 25: Thematic Funds

My personal favorite among the equity funds are the thematic funds. Themes are stories that play out over a period, say 10 years. If you are not that knowledgeable in stocks, jargon, or the technicals — you can still make a killing if you guess the sector right.

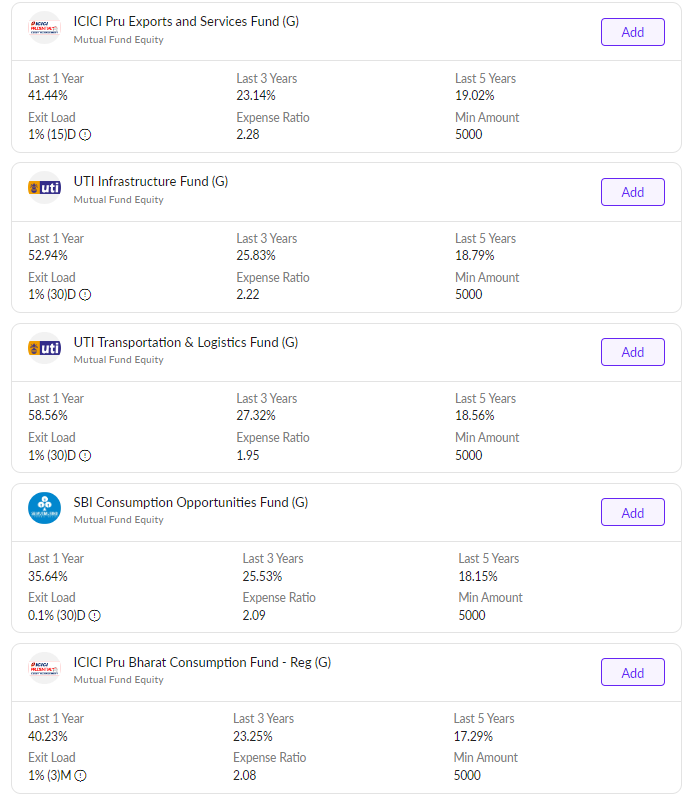

It may take patience for something to be uncovered, but when it does — these thematic/sectoral funds will outperform. A few of the themes that played out in the last 10 years were:-

- Plastics

- Banking and Fintech

- Supply Chain and Logistics

- Information Technology

- Infrastructure

- Electric Vehicles

- Alternative fuels & Green energy

If you guess the sector right, the best way to invest is via mutual funds. The reason is that the holding period is 7 to 10 years and there is every possibility that the stock you are planning to purchase now may not be even a performer after 5 years. MFs do the occasional rebalancing, remove the losers, and add on to the winners thereby protecting your capital for the long haul.

Examples

https://viswaram.com/mutual-funds-day-26-debt-funds-a62d2ffbc3da

If you liked this content, consider sharing it with your friends & relatives..

Book a free consultation — Get your mutual fund holdings audited based on your risk profile — https://learn.viswaram.com/knowmore