Mutual Funds Day 3: Asset Classes & Mutual Funds Coverage

In the last chapter, we learned about a few asset classes the Rich used to invest. As Mutual Funds became famous ordinary people like you and me were able to allocate money to these asset classes.

In this chapter, we will learn about each of these asset classes in detail, few of them are:-

- Real Estate.

- Precious Metals — Gold & Commodities.

- Equity.

- Bonds, Debt Instruments.

- Currencies.

“In matters of money, no man has enough.” ― Lailah Gifty Akita

“Know what you own, and know why you own it.” — Peter Lynch

Real Estate

Real Estate is the most famous asset class in India. People buy apartments & homes and think that they have invested in Real Estate. A Home is a utility, it will only become an investment if you decide to sell and encash it.

Since India went into an economic boom in the early 90s and as we are still growing, the chances of land value appreciating are quite common. We have heard countless stories of people generating 30x to 100x returns over 20 to 30 years.

The value of 1 cent of the land was approximately 12000 in the 1990s, currently, the value is around 7.8 lakhs. Let us break it down and calculate the percentage of returns.

As per Fig (3.1)this compound interest calculator, I got an annual return of 13.07%. Was it a phenomenal return — absolutely NO. The only reason the returns felt magical was because of the time factor. Real Estates are usually overrated, only when you break it down — you can compare it with the other asset classes.

For someone starting now, buying a cent for 7.8 lakhs and then waiting another 34 years would seem not that easy. In 1990, I spent Rs1.32 Lakhs to buy the 11 cents. Today you will have to spend 85.8 Lakhs. If you wait for another 34 years, the projected returns will be as per Fig (3.2) i.e. 55.88 Crores.

The same can be handled via Mutual Funds also, wherein you are entrusting an AMC to buy real estate assets. Your contributions could be in SIPs. The Funds that buy Real Estate Assets are called REITs (Real Estate Investment Trusts).

Few of the listed REITs are (source)

Precious Metals — Gold & Commodities

Gold always has a sweet spot in our lives. It can be used as a Jewelry as well as a store of value. Another advantage Gold has is its ability to generate cash for urgent needs. All we have to do is keep it as collateral and we could get a gold loan.

Let us analyze the returns of Gold over the last 34 years.

The price of 10 grams in 1990 was: Rs3200

The price of 10g in 2024 is: Rs73125

(source)

As per Fig 3.4, Gold gave an annual return of 9.643%

There are other asset classes like Silver, Crude Oil, Natural Gas, Corn, Wheat, Coffee, Rubber, Cardamom, etc. But the penetration of Mutual Funds is not that deep to have coverage on all these.

Gold and Silver have adequate coverage and we have MFs as well as ETFs tracking them refer to Fig 3.5.

Equity

The most famous asset class is Equity wherein you become a shareholder of a popular company. The main reason it is famous is because of the low cost of entry. People can start investing with just Rs500 per month and get the same exposure as people investing Rs5,00,000 per month. If both of them invest in the same Mutual Fund — then the percentage returns are the same for both. It is a system that encourages equality and merit.

There are some keywords like Active vs Passive Funds, Diversification, Expense Ratio, Index Funds etc which we will discuss in detail in a later chapter. Meanwhile, we will assess the ROI for the same tenure.

Sensex price July 1990 — 1000 points

Sensex price now 08 Apr 2024–74742 points

The ROI works out to be 13.53%. It works out to be similar to the Real Estate example above. The advantage Equity has over RE is its cost of entry. A Sensex Index Mutual Fund can have monthly SIP starting at Rs500. An actively traded MF could even beat a passive fund if the Fund Manager is talented.

Bonds & Debt Instruments

Also called as Fixed Income Instruments. A common example is a Fixed Deposit wherein the Bank or Society will give you a flat interest income say 8% in exchange for parking your capital with them.

When it comes to Mutual Funds there are many more options available, A few of them are

- Liquid Funds

- Money Market Funds

- Gilt Funds

- GOI Bonds

- SDLs

The only way a Debt instrument generates money for you is via Interest payments. You could choose to withdraw/reinvest the interest component.

Currencies

Most of them would have used only 1 currency in their lives — INR (Indian Rupee). There are many other famous currencies like USD, GBP, CNY, EUR, etc. Depending on many factors (beyond the scope of this book) the currency of a country could appreciate or depreciate.

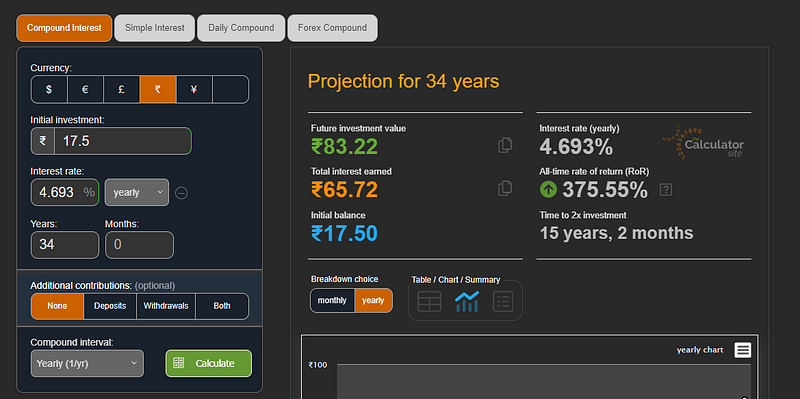

For example. The value of USDINR was 17.5 in 1990 and it is currently trading at 83.2. If we calculate the ROI, it turns out to be 4.693% as per Fig 3.7.

Mutual Funds trading in Currencies or International Bonds are not that famous in India, but we may see new categories like these opening up if there is sizeable investor interest.

The important thing to take away from this chapter is that Mutual Funds have made it easy for common people to invest in these asset classes. For a very long time, these assets were open only for the super-rich.

When you talk to a Financial Advisor, the first thing that they usually do is plan the Asset Allocation for you. They will usually sit with you and discuss what percentage of your money should go into Equity, Gold, Real Estate, and Debt. This allocation percentage varies as per the Income, Age, and Tenure of each client.

https://viswaram.com/mutual-funds-day-4-asset-allocation-diy-vs-professional-9587bf8cb0dc

If you liked this content, consider sharing it with your friends & relatives..

https://viswaram.com/mutual-funds-day-4-asset-allocation-diy-vs-professional-9587bf8cb0dc