Mutual Funds Day 31: Conservative Hybrid Funds

Earlier we learned about equity funds and debt funds. There is one more category called hybrid funds wherein a fund manager decides the asset allocation that needs to go into equity and debt.

When it comes to mutual funds, asset allocation is everything. Two people could invest 10 lakhs into two mutual funds simultaneously but get different results. Money is made only when you hold the right asset for the right duration and that is where a hybrid fund scores over equity & debt MFs.

The credibility of the fund manager has a huge role to play in hybrid funds, if he gets it wrong — he could even lose money for the clients. His view about the valuation of the stock markets, and the interest rate cycle of the debt market have to be accurate.

Having over-exposure to equity during a bear market or under-exposure to debt markets in a rising rate regime could be a disaster. Most often the AMCs will put their best talent in managing hybrid funds.

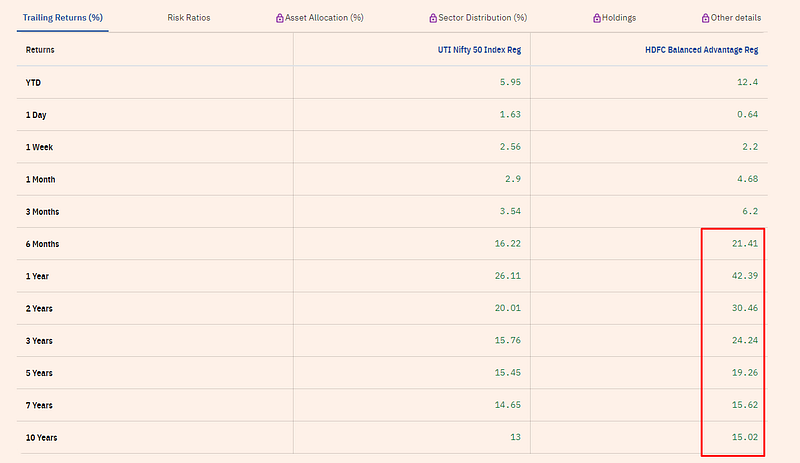

In the figure above, I have compared a Nifty50 index fund vs a Balanced Advantage regular fund, source. The returns are much better for the hybrid fund than the pure equity counterpart. Again the historical returns are not a benchmark in selecting new investments — but hope you got an idea.

Conservative hybrid funds as the name suggests have lower exposure to equity (10 to 25%) and higher exposure to debt (75 to 90%). The annual returns would be usually lower than an aggressive hybrid fund of the same AMC, the reason being equity gives a better return than debt in raging bull markets. India has yet to see a long-lasting bear market and till then equity may continue to outperform debt.

Conservative hybrid funds are an excellent choice over pure debt due to the outperformance it can offer at a slightly higher level of risk. Retired people and senior citizens who would not want a huge equity exposure could also prefer this category.

Examples:

https://viswaram.com/mutual-funds-day-32-balanced-advantage-hybrid-funds-6cdd6cc4fe67

If you liked this content, consider sharing it with your friends & relatives..

Book a free consultation — Get your mutual fund holdings audited based on your risk profile — https://learn.viswaram.com/knowmore