Mutual Funds Day 36: Scheme Summary Document (SSD) | Scheme Information Document (SID)

Scheme Information Document is a mandatory “to read” document issued by the AMCs, but the one least read. Usually, people do not like to read but prefer to listen. Things will work out well if you invest through a mutual fund distributor as he is entitled to explain the SID to you. If you are a DIY investor on the other hand, then make sure you end up reading this crucial document before investing.

Sometimes a scheme summary document (SSD) is provided which is nothing but an abstract of the SID highlighting the major points. SID usually is quite lengthy (eg.100 pages), whereas an SSD will be like 4 to 5 pages.

AMFI has made it easy for anyone to browse and find the SIDs/SSDs. You can refer to the link below to download the same for the funds you have invested.

https://www.amfiindia.com/research-information/other-data/scheme-details

We will now examine why SID is a must read document

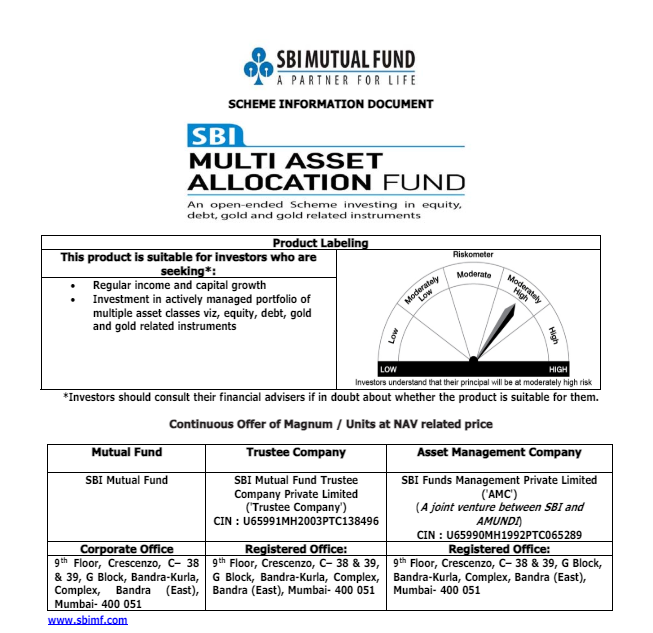

- Product Labeling, Investment Objective — It contains the “suitable for investors” profile. It shows a summary of where the AMC is planning to invest.

- Riskometer — The risk profile will be marked starting from Low —High. An equity fund will have a higher risk profile than a debt fund. Hybrid funds will usually have moderate risk profiles.

- Contact numbers of important persons.

- Asset allocation

- Dividend Frequency

- Minimum Investment Amount

- Minimum Redemption Amount

- NAV Disclosure

- Benchmark

- Exit Loads

- Portfolio Holdings

See the figures below.

Download the pdf version — click here

The takeaway from this chapter is that you should mandatorily read the scheme information document of each mutual fund before investing. The wording “Mutual fund investments are subject to market risk. Please read all scheme related documents before investing.” refers to the SID.

Next Chapter

https://www.amfiindia.com/research-information/other-data/scheme-details

If you liked this content, consider sharing it with your friends & relatives..

Book a free consultation — Get your mutual fund holdings audited based on your risk profile — https://learn.viswaram.com/knowmore