Mutual Funds Day 42: Power of SIP and Step up SIP

Most of you would have heard about SIPs (Systematic Investment Plans). These are very popular among the salaried class of the workforce as the ease of investing in mutual funds is taken care of.

SIPs are when you submit a mandate with a bank to debit an agreed amount and invest in mutual funds automatically. For example, Ramesh is a person who draws a monthly salary of Rs50000 and he wishes to invest Rs10000 (20% of his salary) in Mutual Funds. All he needs to do is contact a mutual fund distributor, do the KYCs, and then schedule MFs to debit the amount on the 5th of every month.

If Ramesh gets too busy with his work, he may not be able to voluntarily invest and this may affect his financial goal. This is where SIP helps. Even without Ramesh’s intervention, the SIP amount was debited from the bank and invested in the MFs he had selected. This ensures that his financial goal stays on track.

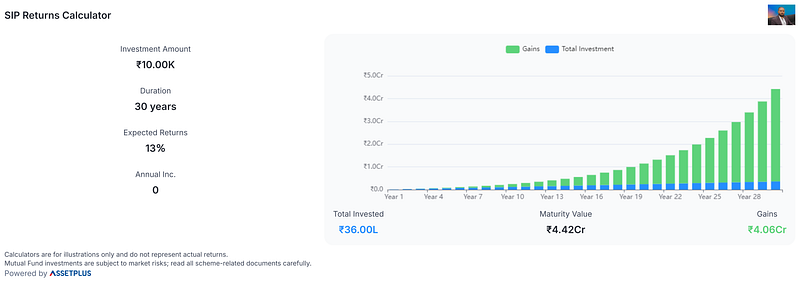

We will look at some numbers and understand why having a long term goal can work in your favor. With time, your funds grow at an accelerated rate due to the compounding effect.

Assumptions

- The investment amount is Rs10000 per month

- The expected annual returns = 13%

Case 1: 5 year Tenure

- Total amount invested = 600000

- Gains = 248033

- Total Fund value = 848033 (1 + 2)

- Absolute returns = 1.41x (3/1)

Case 2: 10 year Tenure

- Total amount invested = 120000

- Gains = 1266807

- Total Fund value = 2466807(1 + 2)

- Absolute returns = 2.055x (3/1)

Case 3: 20 year Tenure

- Total amount invested = 2400000

- Gains = 9055191

- Total Fund value = 11455191 (1 + 2)

- Absolute returns = 4.77x (3/1)

Case 4: 30 year Tenure

- Total amount invested = 3600000

- Gains = 40606469

- Total Fund value = 44206469 (1 + 2)

- Absolute returns = 12.27x (3/1)

You may have noticed that the absolute returns went from 1.41x to 12.27x when the tenure changed from 5 to 30 years. This is just because of compounding. In layman’s terms, it means the returns you made on your original investment started giving you returns.

Let me explain it with another example.

Suppose you invested 100000 and you get returns of 13% per year. After your first year, the total fund value will be 100000(original capital) +13000 = 113000.

For the second year, the returns of 13% apply to both 100000 (original capital) and 13000 (returns) i.e. 113000+13%x113000 = 127690.

This means that the returns you generated in the first year gave a 13% return for the 2nd year. This process continues as long as you hold on to your investments.

Take a look at the 10th year data, the returns have outgrown the original capital. By the 20th year, the returns became 3.77x of the original capital and by the 30th year returns became 11.27x.

Money works for you even when you are asleep.

Step Up SIP is a newer concept. You are incrementing your capital contribution every year. The rationale is that your salary increments every year. Meanwhile, Inflation erodes the value of currency.

If inflation is 5%, then Rs10000 will have a value of only Rs9500 next year.

I am using the step up sip calculator of groww. The same assumptions apply.

Case 1: 5 year Tenure

- Total amount invested = 892992

- Gains = 311380

- Total Fund value = 1204372(1 + 2)

- Absolute returns = 1.34x (3/1)

- Increment percentage: 20% every year

Case 2: 10 year Tenure

- Total amount invested = 3115042

- Gains = 2180795

- Total Fund value = 5295837 (1 + 2)

- Absolute returns = 1.7x (3/1)

- Increment percentage: 20% every year

Case 3: 20 year Tenure

- Total amount invested = 22402560

- Gains = 29684483

- Total Fund value = 52087043(1 + 2)

- Absolute returns = 2.32x (3/1)

- Increment percentage: 20% every year

Case 4: 30 year Tenure

- Total amount invested = 141825788

- Gains = 250995181

- Total Fund value = 392820969(1 + 2)

- Absolute returns = 2.76x (3/1)

- Increment percentage: 20% every year

If you compare both the SIP methods i.e flat SIP vs step-up SIP there are 2 main observations

- The compounding effect is much more visible in flat SIP. 30-year SIP gives 12.27x growth Vs 2.76x for step-up. The reason being, for step-up the majority of capital contribution is near the end of the tenure.

- The capital raised in flat SIP is lower Vs step-up SIP. The reason: the investible amount remains constant for the flat SIP and is not proportional to your rising income and higher inflation. The result is that the final value of investments may not give you adequate cushion for your needs.

I recommend you opt for the step-up SIP if you are in the accumulation phase ie. the 20s and 30s. A higher contribution as investments will also inspire you to cut back on unnecessary expenses.

Next Chapter

https://viswaram.com/mutual-funds-day-43-halal-mutual-funds-94f284d7ad6f

https://viswaram.com/mutual-funds-day-43-halal-mutual-funds-94f284d7ad6fhttps://viswaram.com/mutual-funds-day-43-halal-mutual-funds-94f284d7ad6f