Mutual Funds Investing Strategy 102: Can you fund a holiday package via mutual funds?

Only a handful of people would not like to travel, see places, make new friends, or taste new food. For the rest of us, travel is everything. But I personally know many people who are not able to take that dream vacation every year, mostly it is due to either of these 2 issues

- Lack of time — busy job schedule.

- Lack of money — prioritized other investments over yearly travel.

Let us explore both these points in detail.

Lack of time: Modern slavery is quite similar to the olden days. The only difference is that you get paid a lot these days you don’t realize it is bondage. Many people are unable to take a week off from their job schedule, either their managers won’t grant them the leave, or they might just be too busy with other things.

Lack of money: The reference here is not on a poor household, I am quite sure they will need more money for the essential needs let alone a vacation. The example here is someone who is financially well off but cannot travel because he made poor asset allocations. He might have purchased a villa or an apartment, invested in some businesses, and is overwhelmed by the EMIs and loans.

What is the solution?

I would say the answer lies in goal setting, if you have not read the “goal setting chapter” yet, please do.

https://viswaram.com/mutual-funds-day-1-setting-a-goal-6529fe676c70

The idea is to consider “Vacation” as a separate goal and fund it systematically. Since you need a vacation every year, be prepared to redeem the funds for use as well. Set reasonable expectations and stay disciplined.

The example quoted above is for someone who needs Rs1,20,000 per year for vacation, for them a SIP of Rs10000 per month will reward them handsomely. If your travel expenses are on the higher side, your contributions will have to go up proportionately as well.

First Year Calculations

Assumptions

- Monthly contribution: Rs10000

- Total contributed = Rs1,20,000

- Total fund value = Rs1,29,500

- Appreciation: 9500

- Period: 1 year

- Annual Yield: 14%

Second Year Calculations

Assumptions

- Monthly contribution: Rs10000

- Total contributed = Rs2,40,000

- Total fund value = Rs2,78,340

- Appreciation: 38340

- Period: 2 year

- Annual Yield: 14%

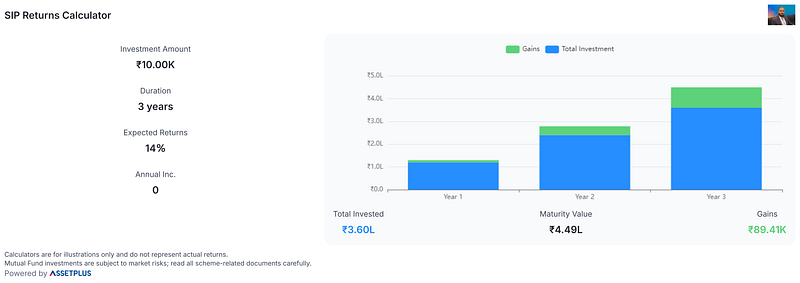

Third Year Calculations

Assumptions

- Monthly contribution: Rs10000

- Total contributed = Rs3,60,000

- Total fund value = Rs4,49,410

- Appreciation: 89410

- Period: 3year

- Annual Yield: 14%

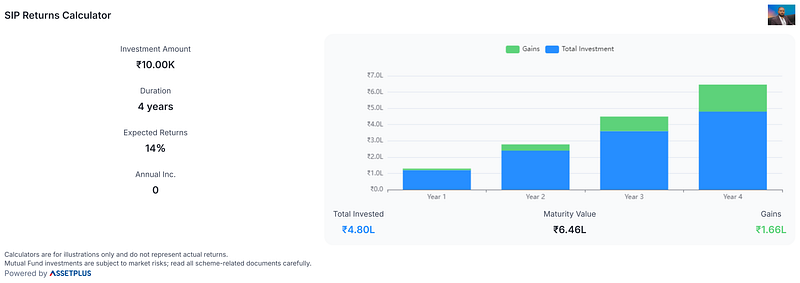

Fourth Year Calculations

Assumptions

- Monthly contribution: Rs10000

- Total contributed = Rs4,80,000

- Total fund value = Rs6,46,000

- Appreciation: 1,66,000

- Period: 4year

- Annual Yield: 14%

Calculators are for illustrations only and do not represent actual returns.

Mutual Fund investments are subject to market risks; read all scheme-related documents carefully.

In the examples quoted above, a cumulative plan will only work out if there are no redemptions. Ideally, the holiday fund will have yearly redemptions — so the actual calculations will have variance.

The choice of the funds selected will totally depend on your wealth manager. Please get in touch with them to plan this out. It is not a bad idea to go with hybrid funds in the first year if you are a newbie in mutual funds investing. Hybrid funds have a lower risk profile than pure equity funds.

The best plan is to avoid the redemption for the first year and start redeeming it 2nd year onwards. This will ensure you have a residue amount that will fetch you incremental returns over the years.

If you liked this content, consider sharing it with your friends & relatives..

Book a free consultation — Get your mutual fund holdings audited based on your risk profile — https://learn.viswaram.com/knowmore

Disclaimer: Calculators are for illustrations only and do not represent actual returns. Mutual Fund investments are subject to market risks; read all scheme-related documents carefully.