Mutual Funds Strategy 115: Will 3 Crores Be Enough For Retirement?

What would be your ideal retirement corpus? When I ask this question to my clients, the responses are usually surprising. Most of them overestimate what they could do in 1 year and underestimate what they could do in 15.

In my opinion, an upper middle-class Indian household would require 3 crores to retire financially independent. Due to rising health care costs, the only other thing you need to do is cover your risks with adequate health/life insurance. Even if you choose to retire from your active income, the passive income will propel you forward.

Allow me to break down the numbers.

You can raise 3 crores in 5, 10, or 15 years — it all depends on your disposable income and savings rate. Let me assume the annual returns at 13% and the inflation at 4%.

Case 1: To raise 3 crores in 5 years, the SIP amount required = 4.3 lakhs/month. Your inflation-adjusted goal goes to 3.65 crores. The approximate gain on your investment is ~ 1.07 crores.

Case 2: To raise 3 crores in 10 years, the SIP would be 1.8 lakhs/month. The inflation-adjusted goal is now 4.44 crores and the approximate gains are ~ 2.28 crores.

Case 3: To raise 3 crores in 15 years, the SIP would be 97 thousand/month. The inflation-adjusted goal is 5.40 crores and the approximate gains are ~ 3.65 crores.

To get the spending power of 3 crores today, you need to raise 5.4 crores in 15 years. That is how much inflation is eating into your investments and that too at a conservative estimate of 4%. If we assumed an annual inflation target of 6%, then the inflation-adjusted goal after 15 years would be 7.2 crores. This puts added responsibility on you/your financial advisor to find investments that provide a better inflation-adjusted return every year.

The earlier you raise this 3 crores, the better you are placed in compounding your annual returns. Let me give you a comparative illustration.

The person in case1 would have raised 3.65 crores in 5 years. If he stops further inflow of capital and just chooses to keep this portfolio intact, the final corpus value after 15 years would be 8.37 crores instead of 5.4 crores as per case3.

Now coming to the retirement part.

We need to know how to plan our monthly expenses in such a way that our corpus will continue to give us passive income, just like the golden goose. We should also be careful not to kill the goose, otherwise we would not get the golden egg frequently.

Case1: The investor retires in 5 years with a corpus of 3.65 crores and this investor requires a monthly withdrawal of 2.5 lakhs for 40 years. I am assuming the annual rate of returns at 9% (Proposed returns minus inflation).

This investor will be left with a corpus of ~ 13.89 crores at the end of 40 years even if they withdraw 2.5 L/month.

Case2: The investor retires in 10 years with a corpus of 4.44 crores. Monthly withdrawal is 3 lakhs for 35 years. Net annual returns at 9%.

The investor will be left with a corpus of ~ 13.49 crores at the end of 35 years even if they withdraw 3L/month.

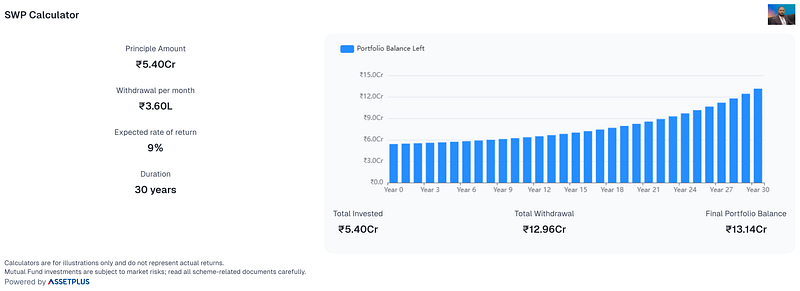

Case3: The investor retires in 15 years with a corpus of 5.40 crores. Monthly withdrawal is 3.6 lakhs for 30 years. Net annual returns at 9%.

The investor will be left with a corpus of ~ 13.14 at the end of 30 years even if they withdraw 3.6L/month.

The beauty of the above systematic withdrawal examples is that the retirement age remains the same for all three cases and the final corpus is relatively the same ~ 13.14 to 13.89 crores at the end of 45 years.

Case1: Invest for 5 years, withdraw for 40 years.

Case2: Invest for 10 years, withdraw for 35 years.

Case3: Invest for 15 years, withdraw for 30 years.

If we go by the above examples, the withdrawals are so planned that you never run out of funds. If you are 40 years old now and planning for either of the 3 cases, you will still have the funds when you are 85. However, if your monthly withdrawal is exceeding the threshold or your retirement corpus is less than 3 crores — then you may fall short of the target.

Please note that this financial modeling requires an adequate amount of research, effort, and time. It is highly recommended that you do the permutations and combinations through an expert.

Hope you got some insights into retirement planning today. If you liked this article, consider sharing it with your friend or relative who could benefit from this.