Nifty Analysis — Stance Bearish⬇️

Nifty Analysis — Stance Bearish⬇️

Recap from yesterday: “Once we breached the support, there was no attempt to retrace. One thing is missing though — momentum. The weak hands still hold the shorts..”

Nifty went ahead and broke the recent swing low. The lowest point today was 21710. From the open till 10.47 — the index played as per script, but what needs attention today is the 220pts ~ 1.02% recovery. I am reiterating how bad the situation is when “weak hands” hold the CE shorts. Thankfully we did not cut through the 21913 resistance, otherwise whatever bearish setup we had created would have split open.

There is also mention of BankNifty falling, but needing to fall more. The index only lost 0.16% today, that’s not enough to break through the PUT shorters. Momentum is a great thing in technical analysis, the trend starts only when the momentum is in favor because if things stay as it is — markets will recover.

On the 63mts time frame, Nifty is perfectly positioned. Today’s down move was received well among the traders, just when we thought a bigger movement was going to happen — the reversal took place. Tomorrow is the weekly expiry and things could get interesting. We still maintain the bearish stance below 21913.

BankNifty Analysis — Stance Neutral ➡️

Once again BN proved to be resilient to the bearish attack. We briefly broke the bearish channel top line, hit a new intraday low of 45828, and then reversed from there. The reversal was a whopping 828pts ~ 1.81% on what we could call a bear market killer. Whatever green candles we had in that recovery were strong and had good depth. The only reason N50 had that dramatic reversal was due to BankNifty.

Most of the analysts are bearish on BN, but I am still not convinced. Yes, we had a drop of 2317 points ~ 4.81% overall but the downside moves are not convincing enough. Primarily because the momentum is still not there, compare it with N50 and you will get the variance. All BN has to do is enter the bearish channel and then we can go short with a higher conviction. Meanwhile, I modified the bearish channel bottom line (purple color line), connected the recent price actions and finally, it is looking parallel to the top line (blue) as well.

Algo Trading

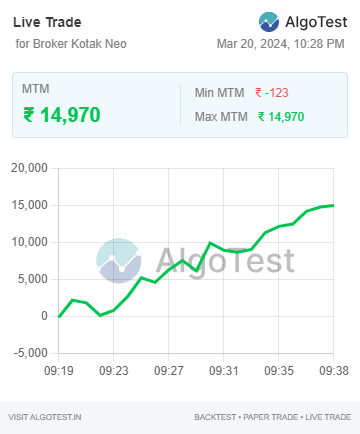

Our algo trades ended today with a gain of 14970 points. Sensing the situation getting a bit volatile, I manually squared off the positions at 09.38.

Webhooks automation run via TradingView on Dhan