Nifty & BankNifty Analysis — 09 May 2024 — The decision to stay Bearish paid off handsomely—…

Nifty Analysis — Stance Bearish⬇️

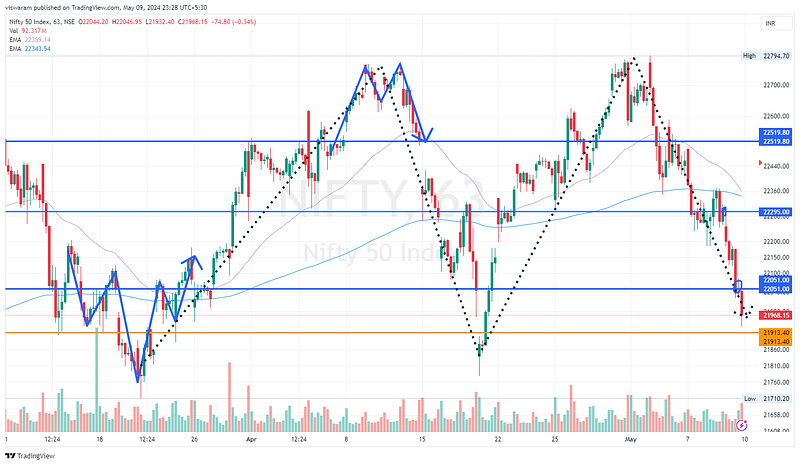

Recap from yesterday: “On a closing basis, N50 finished the day above 22295 at 22302. Ideally, I should change the stance from bearish to neutral, but let me give the benefit of the doubt to the Bears for one more day.”

If you look at the horizontal lines, it may appear like I drew them today after the Nifty’s move. Thankfully many of my readers know pretty well that these lines were drawn way back and somehow the support/resistance levels look magically working.

Nifty opened below the 22295 level, closed the gap, and then started falling. The first candle gave the impression that N50 would stay neutral today, but after the 3rd candle, things were looking quite resourceful for the Bears. Even then, I never thought we would fall 345 points today, the max target I had in my mind was to retest the 22051 levels and then settle there.

22051 SR zone is shown in the 2nd blue highlight. From 12.51 to 14.31, N50 spent its time there before breaking down. The next major support was at 21913, but we did not go there thankfully.

On the higher timeframe, N50 has made a massive double top, see the black dotted line. If it materializes, it could even be a real shocker to the bulls out there. Just like we discussed this week, if 21913 is getting taken out, the inverse H&S pattern will get negated.

I am not really sure how my algos are minting money. The strategy I have is straddles and ideally in trending markets, I should be losing — maybe it has something to do with the unusually high VIX.

BankNifty Analysis — Stance Bearish⬇️

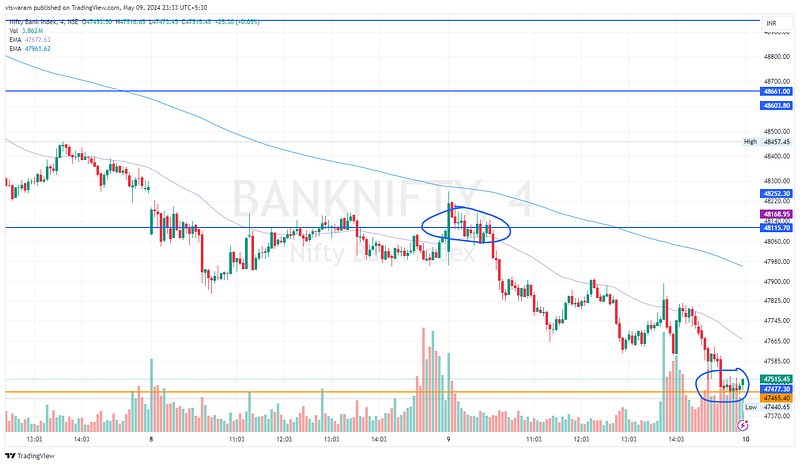

The bearish call on the BN was spot on, but we ended the day less bearish than N50, for me that is not good enough. Most importantly, BN did not breach the support of 47465, this was very crucial for the momentum to build.

I am not exactly sure if we will start negatively tomorrow or not, a huge gapup or gapdown may work in our favor, but if BN is opening flat at the SR level — it may even move up a bit. 47465 for me was the critical support that we failed to break.

The price action on a few of the bank stocks looked pretty scary. HDFC Bank -2.37%, IndusInd -2.85%, RBL Bank -3.07%. The only reason we did not fall that much was because ICICI Bank, Kotak, and SBI were holding good at the other end.

The biggest doubt I have these days is Kotak is at multi-year lows, HDFC Bank is almost at the 2020 levels but BankNifty is simply near the ATHs — is ICICI, SBI, and Axis Bank responsible for the stark outperformance???

The stance is still bearish, but the first thing we need to do in the morning session is to take out the 47465 levels failing which we could get a minor pullback or short covering.

Algos ended up generating 8253 INR, not bad despite a trending day.

Webhooks automation run via TradingView on Dhan

Book a free consultation — Get your mutual fund holdings audited based on your risk profile — https://learn.viswaram.com/knowmore