Nifty & BankNifty Analysis — 15 May 2024–Nifty gets a mild rejection at 22295 — PostMortem Series…

Nifty Analysis — Stance Neutral ➡️

Recap from yesterday: “I am hard-guessing it should be a short covering. The moment we get past 22295, we will be forced to go long.”

The open was good and we started climbing quickly but at 22295 levels we got our first rejection. Four strong red candles between 09.51 and 10.27 brought N50 down by almost 143 points. If 22295 was breached, we would have changed our stance from neutral to bullish.

The good thing for the bulls was the fall ended at 10.27, for the remainder of the day we went into a small range bound trade. The final close was flat at -0.08%.

On the higher timeframe, we need to take out the resistance pretty quickly otherwise this pullback will start forming a lower high. A lower low, lower high formation is a bearish pattern and that would also mean the next leg of the down move will be more aggressive. At present we prefer to stay neutral till we get more clarity.

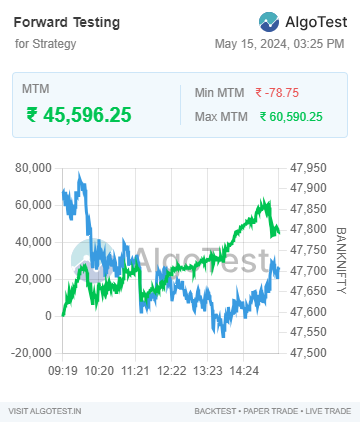

The algos made a profit of 15750 INR, MTM was into a loss earlier on, but after 11 am things started improving.

BankNifty Analysis — Stance Neutral ➡️

BN ended the day with cuts of -172pts ~ -0.36%. We went neutral after the price action on 13th May. After that, we had one up day (14th) and a down day (15th) — the result, we are back in the neutral territory.

BN did not even go to the 48115 levels which came as a surprise. Ideally, on 16th there may be an attempt to take out 48115 resistance, only then the Bulls can exert their dominance. If it stays like this, we get another lower low formation and it would mean the Bears will come back much stronger. Only if 47465 is broken, we will change our stance from neutral to bearish.

The algos made a super profit of 45596 INR today.

Webhooks automation run via TradingView on Dhan

Book a free consultation — Get your mutual fund holdings audited based on your risk profile — https://learn.viswaram.com/knowmore