Why Health Insurance should be a mandatory product in India

Currently, health insurance is not a mandatory product in India. With the rising cost of healthcare and the speed at which newer variants of diseases are identified — there is no way a common person can keep up by paying expenses from their pocket.

Even a decently well-off household is just a bill away from bankruptcy. The only practical solution available is to transfer this risk to another party and when you do so, you end up paying a cost called a premium.

People usually prefer to pay for something that gives them instant satisfaction. When you pay Rs250 for a movie ticket, you prefer to enjoy the movie right away. When you buy a pizza for Rs500, you get to enjoy the pizza. When you pay Rs1000 for petrol, you get the dealer pump fuel to your car’s tank.

People will be hesitant to buy the same products if the exchange of goods happens at a later date.

- Will you pay Rs250 today so that you get the rights to watch a movie after 30 days?

- Will you pay Rs500 today if the shopkeeper promises to deliver the pizza exactly 2 months from now?

- Will you pay Rs1000 for petrol if the dealer promises to refuel your car for Rs250 for the next 4 weeks?

The chances are that you will not agree to a deal when you have to pay up instantly but the benefits are realized in the future. This is the secondary reason Insurance is not a hot-selling product. The primary reason of course is the nagging undying attitude of the insurance agent.

The perspective will change if you think of Insurance as a risk management tool. Let me give you some examples to open up your mind.

- If your son is in the 10th standard and you wish him to score excellent grades, you would pay extra money and send him for evening tuition. You pay money to derisk his chances of failure.

- When you go for a long trip, you fill your petrol tank more than usual thinking you may not find a fuel station when required. Here you are avoiding the risk by spending money earlier than it is required.

- When you appear for a job interview, you usually choose the first offer than the best offer. Here you are derisking the possibility of unemployment in case you reject the first offer because you never know if you will even qualify for the best offer.

Insurance is a method of transference of risk. You are entrusting a company to cover your risk and for that, you are ready to pay a fee which is called Insurance Premium. The insurance company on the other hand receives premiums from a group of people and hopes that very few of them actually face the risk.

We will analyze the costs of insuring a 4-member family below, but the premiums you pay will de-risk you from a lot of mishaps that follow. Health insurance claims come via hospitalization. Either the insured will be sick or would have met with an accident. As a bystander, you would not have enough strength to negotiate the terms of treatment then.

If the PRO says the MRI will cost you 13500 but you feel it usually quotes around 10000 — you would not have the time or mindset to argue and negotiate.

Last month I spoke to a mother who had her daughter hospitalized due to dengue. She was literally crushed and demoralized when the doctors said they had to extend the treatment. Due to a compliance error from her insurance agent, she was not able to use the cashless facility as well. One of the reasons she was in deep trouble was that she had to shell out cash from her own pocket and she did not have enough in the bank.

The month before that, I spoke to my development officer and he was literally out of words when he said, no company can cover his health insurance. He had a fatty liver and with this known risk, the health insurance company could demand additional premium or alter the standard contract.

The best time to take a health insurance policy is when you are healthy. Even if you develop any complications after the policy date, the risk falls on the insurance company and they cannot deny the claim. That does not mean that you ignore fitness and exploit your body.

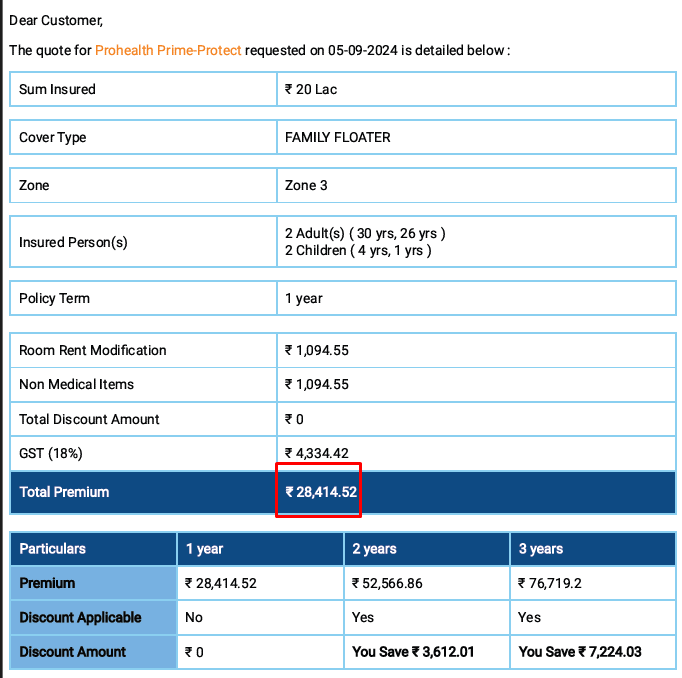

Today we will analyze the costs and benefits of health insurance for a household with

- Ramesh, Age: 30

- Rekha, Wife, Age: 26

- Rahul, Son, Age: 4

- Radha, Daughter, Age: 1

Case 1: Umbrella coverage of 5 lakhs for the entire family will cost them Rs17717 per year.

Case 2: Coverage of 10 lakhs per year, premium cost is Rs23828. You may notice that you got an extra 5 lakhs coverage at a nominal increase of 6111 rupees, i.e. 100% sum insured at a 34.5% increase in premium

Case 3: 20 lakhs per year, premium cost is 28414. The hike in sum insured w.r.t 5 lakhs is 300%, whereas the premium went up by only 60%. If we compare with the 10 lakhs plan, the sum insured went up by 100% and the premiums went up by only 19.2%.

If you can spare some additional funds now, the best-recommended option is to max out your sum insured selection. You never know what will be the rise in the cost of health care a few years later.

Some of the additional benefits this household gets are:-

- Supreme Bonus: where the total sum assured becomes 10 L for the 2nd year, and 15 L for the 3rd year. The max permitted bonus is 800% — click to learn more.

- Zero deductions on non-medical expenses. These are expenses like the consumables which usually are paid by the end customers.

- Unlimited Restoration up to 100%. Even if you use up your 5 lakhs coverage, the insurance company will reset it for you. click to learn more

- Complimentary health check-ups every year.

If you liked this content, consider sharing it with your friends & relatives..

Balachandran Viswaram | www.viswaram.com | +917736010203

https://learn.viswaram.com/sbihttps://learn.viswaram.com/sbi