Why is Indian stock market outperforming the S&P500? Or it does appear outperforming??

I was personally researching the divergence in SPX and Nifty50. The real reason being the negative performance of SPX in 2022 whereas a buoyant outperformance by Nifty during the same period.

I started comparing SPX in USD and Nifty in INR and as soon as I shifted the currency of Nifty50 to USD that divergence went away.

So the next step was to find what caused this and the obvious answer was the depreciation of INR vs USD

As long as our Fiscal policies & RBI decide to let the INR fall — our stock markets will remain elevated in USD terms. Now the people here start saying India will become a super power in X years and become the 2nd largest economy in Y years.

Fundamentally I am quite worried how we are going to achieve that with USDINR at all time highs. It’s like a double edged sword — the central bank cannot strengthen the INR without pissing off the equity investors.

Now on the rate hikes part — the story is more complicated.

US FED has gone from 0.25 to 5.5%

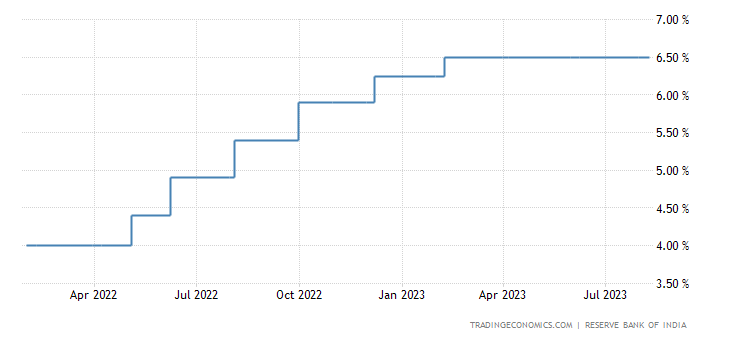

India RBI has gone up from 4% to 6.5%

So in percentage terms 2100% vs 62.5%

I still believe RBI has not hiked enough to encourage the savings rate (first problem) and much worse is the relative attractiveness of US debt vs Indian debt. Did they get the inflation under control (second problem) as the new loan growth is not slowing down enough.

You get 5.5% in USD vs 6.5% in INR — so logically investors will shy away from Indian debt. If I had a choice, I would have preferred the US debt over Indian debt. As the depreciating INR will give an additional 8 to 9% returns too.

Combining the above 2 scenarios, my question is: do the fiscal policy makers want FIIs to invest in Indian equity alone? and ignore debt ??

If yes, setting a course of depreciating INR combined with a lower spread of RBI rate:FED rate looks good.