Why will Kotak Securities give the new brokers a run for their money?

Kotak Securities was founded in the early 1990s and is one of the oldest brokers who are still in business today. The broking industry can be classified as pre-2010 and post-2010 eras as Zerodha opened shop in 2010 and has redefined the broking space altogether.

I have been in mutual funds from 2005–06 and actively trading from 2009–10. Prior to Zerodha, most brokers used the percent commission model instead of a flat per-order brokerage.

The rates prevalent then were 0.3% of the traded value. For example, if you buy stocks worth 1,00,000 you would end up paying Rs300, and if you sold them the next day you would end up paying another Rs300. Zerodha disrupted this industry by offering 0 brokerage for buy and sell of stocks if carried forward overnight.

The most popular trading strategy was BTST i.e buy today sell tomorrow wherein you buy a stock today and expect it to rise and sell it off within a 7 day window. Zerodha might not have offered any incentive for this BTST trade — but its free brokerage definitely helped it pick up market share.

Well, equity forms only a fraction of the total business volume in markets, the main segment that mints money is the Options segment (Futures & Options). Earlier on this segment was too hard for the retail traders to get their hands on — again due to high brokerage and the initial capital required.

Zerodha introduced a free flat brokerage of Rs20 per order instead of commission on volume. And over the period 2010–2020, this small change inspired a generation to try and excel in this new segment. What was once considered pricey became open for all.

That was just the start, with the covid lockdown more professionals entered this arena mostly because their businesses went bankrupt, jobs became obsolete or got fired. It happened to me, but now it proved to be a blessing.

Zerodha was the first broker to capture this immense surge in account opening, mainly because of the following advantage

- Charts integration

- Simple & easy watchlist, portfolio management

- Browser-based ordering system

- Scalability and flexibility

- Collateral pledging

- Simple ledger & fund management

- Profit & Loss management

- Mutual funds integration in portfolio

Soon other brokers also started gaining traction with respect to newer customer acquisitions, feature updates & cost revision. I could say between 2020 to 2023 there was an intense war among the top 10 brokers to gain the attention of prospective customers. Except Zerodha almost everyone else was into all kinds of advertisements, influencer marketing & social media war!

Even though the decade 2010 to 2020 belonged to Zerodha, there might be a great reason why Kotak securities may steal the show in 2020 to 2030 period — Intraday Free Brokerage.

There are a few handful of brokers who provide free brokerage plans like Finvasia, Mstock. Kotak Sec. has got a huge window of opportunity unlocked.

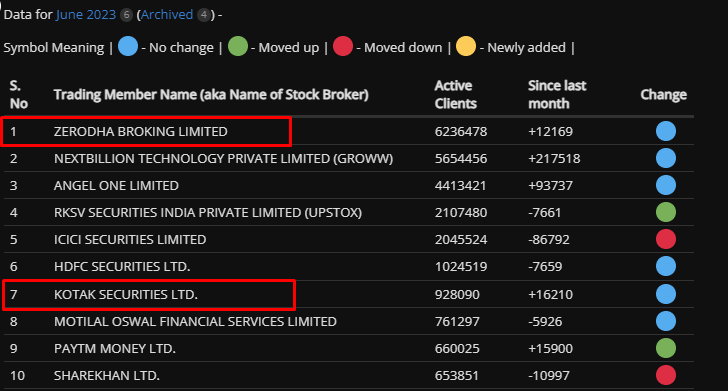

As per this article, Zerodha has 6236478 active clients and Kotak has 928090. This means Kotak is only 14% of the size of Zerodha as of June 2023.

Why is free brokerage that important?

There may be 3 invisible categories of traders out there

- Beginner

- Intermediate

- Advanced

Beginners are all the new starters out there, they may not have set up a trading plan nor found a clear edge in their trading. This segment of people shells out the highest brokerage. I think they spend between 20 to 30% of their earnings on brokerage & transaction costs.

Intermediate guys have found their edge and are happy with their trading. This segment pays out the lowest brokerage. I think they spend 0 to 10% on brokerage costs.

Advanced guys are the algo traders & guys who rely on automation. They have a similar model to high-frequency trading and this segment of people generates the highest trade volumes. Their brokerage costs are between 10 to 20% of earnings.

Beginners always decide to go with zerodha, because that’s the easiest option out there. The simplicity, transparency, and ease of use will attract any college grad to try zerodha. In Fact all the new generation brokers find it easy to convert these college goers, salaried people to their loyal customers.

But the next segment is where Kotak can really tighten its grip. After a while, only a few of these newly-joined demat holders persist. Others would have stopped trading due to losses or would have got busy with their regular jobs. The ones that still trade would be the guys who are profitable. And most importantly any person who wishes to maximize their profit potential will look at lowering their expenses and costs.

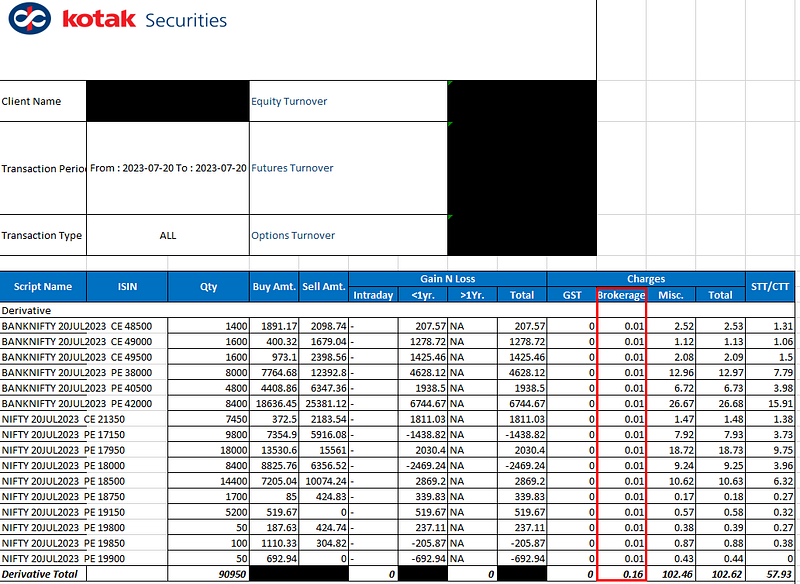

The easiest way to lower the cost is by going ahead with a free brokerage plan. I have attached a snapshot of the trade done on one of my accounts on 20th July 2023. I had subscribed to their intraday free plan due to which I ended up paying only Rs0.16 for the entire day. Their plan says you need to pay Rs0.01 for each contract (fair deal).

I ended up transacting 90950 qty in banknifty & nifty50. I ended up punching 147 orders that day, meaning if I had gone even with a broker that offers Rs20 per order — I would have paid 2940 + 18% GST as brokerage.

If Kotak can lure this segment of account openers from the 2020 covid lockdown (obviously the guys that are still continuing). Then in no time, they can quadruple their market share. These intermediate traders require no hand-holding and most of the time are fit-it and forget-it type of accounts. Other than the account opening, these people rarely call the customer service desk for X or Y.

Now that Kotak has started offering a wider list for collateral pledging, it will definitely catch the attention of this segment. (Emphasis on the pledge acceptance for GOI bonds, Gsecs.)

The only risk is if the trading terminal or server runs into problems — these intermediate traders will leave a bad taste. Most of these traders are semi-famous either for their trading followers or their fan followers on social media.

I am not writing this to improve my referral sales nor I am paid for doing this. I felt this article could benefit the people who are shifting gears from beginner to intermediate.

The third category of people are Advanced Traders, they rely on automation to get most of their trades done. Most of them would be using their own system created using an algo, webhooks, or APIs to place orders rather than depending on the broker’s platform.

The count of orders that they place every minute runs pretty big. These guys put a lot on the line & hence dependency and reliability scored over saving brokerage. That’s why most of them still prefer to pay a flat monthly fee of Rs2000 to Rs5000 per month just to use the API license.